Published 27 June 2023

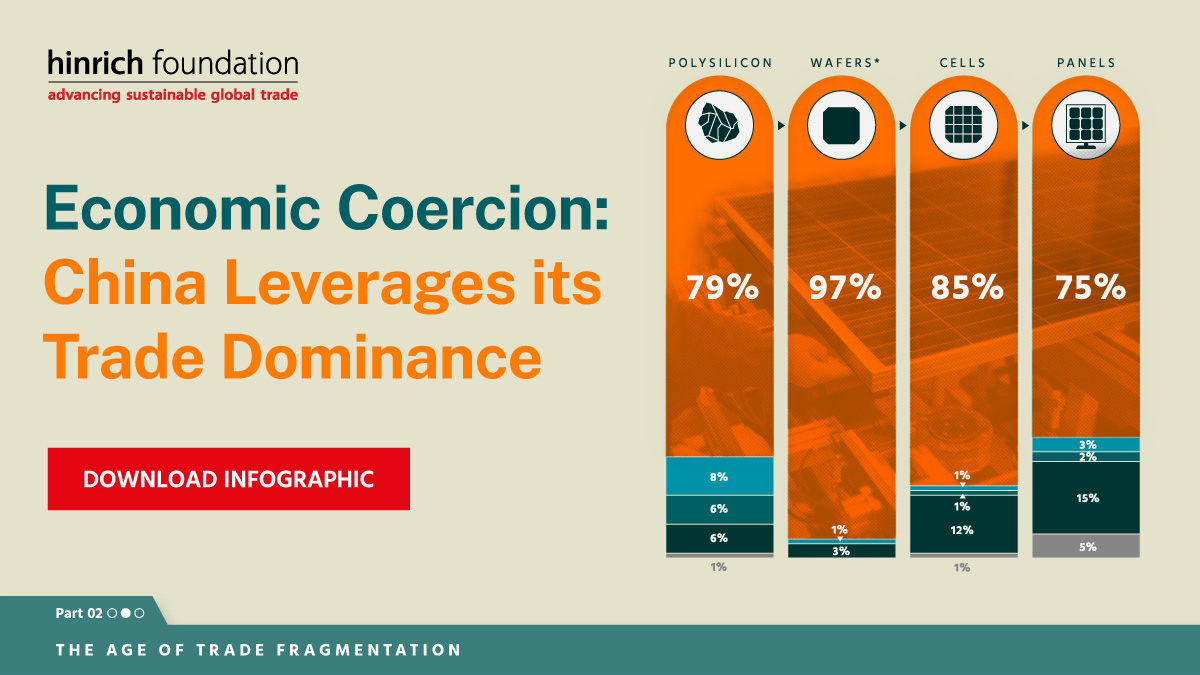

China's use of its economic heft for foreign policy purposes has been on the rise over the past decade. In December last year, China threatened to ban exports of key solar energy products as it weighs ways to weaponize its control of the sector's supply chains. Visual Capitalist shows how China leverages its trade dominance in this illustration, part of our collaborative series ‘The Age of Trade Fragmentation’.

(Text by Chuin Wei Yap)

In 30 years, China has risen from producing 3% of the world’s factory output to become the world’s largest manufacturing economy. It has used this dominance in a pattern of economic coercion against its trading partners.

Two events in 2010 illustrated how pivotal a convergence of these trends have become. China eclipsed the US as the world’s biggest factory that year.

In September 2010, a Chinese fishing vessel deliberately rammed two Japanese coast guard ships in waters administered by Japan around an island chain claimed by both nations. When Tokyo detained the Chinese crew, Beijing launched a trade embargo in all but name, cut off intergovernment contact, organized anti-Japan boycotts and protests, and began blocking Chinese shipments of rare earths, a class of commodities vital to high-tech industries. China controls most of the world’s rare earths output and processing.

Tokyo handed the Chinese crew back, without charges.

Such coercion is not the only instance of challenges to rules-based global order. Neither is China the only nation that practices such economic statecraft; the US does too. But Beijing’s trade dominance, the uniqueness of its state-centric economy, and the frequency with which it uses its commercial power to gain strategic advantage in foreign policy increasingly are factors driving geoeconomic fragmentation.

In December last year, the Chinese government published a proposal to introduce export controls and bans on more than 100 technologies, including equipment to process silicon wafers, a key component for manufacturing photovoltaic cells for solar panels.

As Visual Capitalist shows in this latest illustration of our series ‘The Age of Trade Fragmentation’, the Chinese move is a weaponization of economic interdependence. China is by far the world’s largest maker of solar energy technology and controls a large majority of every stage of the global solar energy supply chain.

Beijing hasn’t acted on this plan yet. But its implicit threat is coming at a time of rising global geopolitical tensions particularly with the US and Western allies over everything from China’s financing of Russia’s war on Ukraine to Chinese state subsidies to its state-owned firms.

As Matthew Reynolds and Matthew Goodman note in their report this year for the Center for Strategic and International Studies on the subject, China’s deployment of economic coercion has usually targeted smaller economies that are highly dependent on the Chinese market. They include Australia, in retaliation for Canberra calling for a probe into the pandemic’s origins; Norway, for the Nobel Committee awarding the Peace Prize to a Chinese dissident; South Korea, for allowing missile deployment on Korean soil; and Canada.

China remains one of the greatest beneficiaries of rules-based international trade. When it deploys asymmetric advantage in international commercial ties in pursuit of goals in foreign policy, it risks an escalation of geoeconomic fragmentation – and a coalescing partnership among targeted nations to deter and deny such coercion.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).