Published 06 September 2019

The global race to "win" in semiconductor innovation and production is at the front and center of the trade war – for better or for worse.

Small and mighty

In one of the most successful branding campaigns, “Intel Inside” helped us all become aware that semiconductors are the brains behind modern consumer electronics in our computers, in our mobile phones, in our televisions and in our cars. It’s wondrous such power begins life as grains of sand (and other pure elements). The silicon in sand is purified and melted into solid cylinders that get sliced into one-millimeter thick wafer discs. The discs are polished, printed with circuit designs, and cut into the tiny individual semiconductor chips that get embedded into our devices.

The next generation of smarter and more powerful machines will rely on even more sophisticated semiconductors to achieve new capabilities. The pace of change is dizzying. Pressure is on to “win” in the global chip race, which is why efforts to protect innovations in chipmaking are front and center in the current trade war – for better and for worse.

Strength in numbers

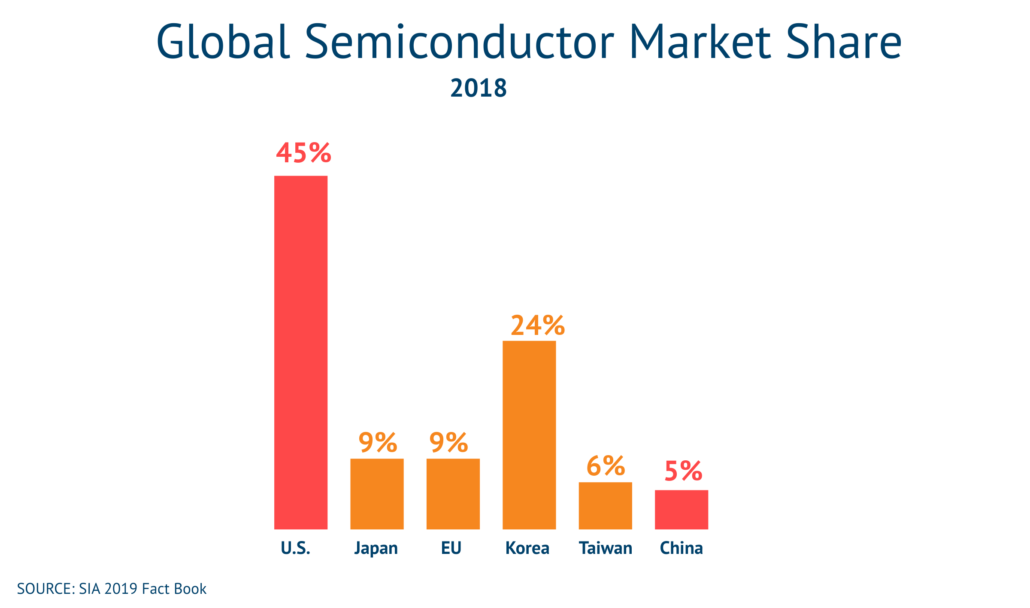

The American semiconductor industry dominates the field with close to half of the global market share. Some industry leaders thrive by maintaining a high degree of vertical integration, but most have achieved a competitive edge by developing reliable value chains that leverage industry clusters located in different regions, while also tapping into the expertise of thousands of small, niche firms inside and outside the United States.

Some firms focus on supplying raw materials or manufacturing equipment, others create “intellectual property cores” or the building blocks for chips, or cultivate skilled engineers who lay out the circuitry of chips. Closer to the end users are companies that have achieved efficiencies in manufacturing, assembling, testing, packaging and distributing semiconductors.

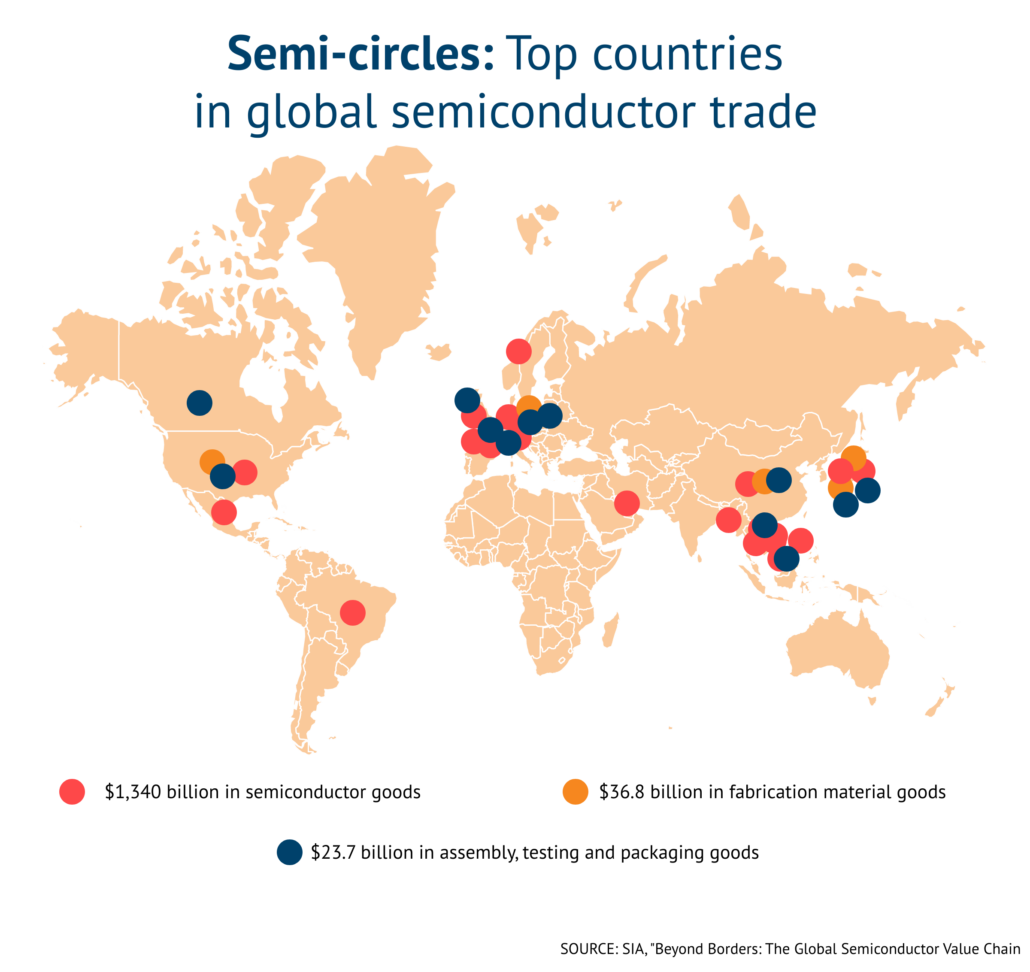

According to the Semiconductor Industry Association (SIA), Canada, European countries and the United States are leaders in semiconductor design and high-end manufacturing. Japan, the United States and some European countries are main sources for equipment and raw materials. China, Taiwan, Malaysia and others in the Asia-Pacific tend to concentrate in the manufacturing, assembling, testing and packaging segment of the industry. R&D hubs are spread across the world.

One American company might have over 7,000 suppliers across almost every state and also have another 8,500 suppliers outside the United States. In creating strategic value chains, American companies can invest in R&D to advance the science while keeping production costs down.

China’s growing chip army

The Trump administration approaches trade with China through the lens of national security as well as economic preeminence. As the Economist rightly points out, in this clash of economic titans, “the chip industry is where America’s industrial leadership and China’s superpower ambitions clash most directly.”

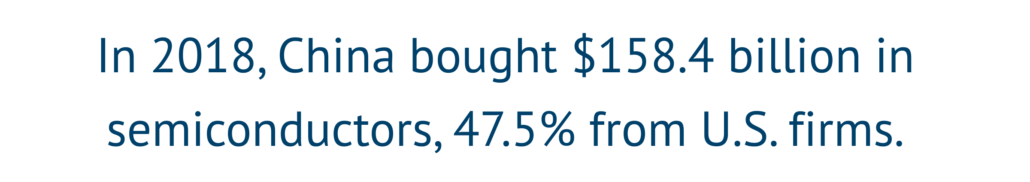

China currently spends as much on imported semiconductors every year as it does imports of crude oil. Importing semiconductors was crucial to China’s ascendance as an assembler of telecommunications equipment, computers, displays, monitors and a variety of electronic components that China exports around the world.

But it’s high-end semiconductor development and manufacturing that China has its eye on now as the foundation for sustained economic growth and military might. Under its “Made in China 2025” strategy, the Chinese government set a goal to supply 40 percent of its own semiconductor needs by 2020, increasing to 70 percent by 2025.

Enlisting the big guns

US firms spend twice as much on R&D as their Chinese counterparts – 17.4 percent of sales versus 8.4 percent. How to counter? Pull out some big funding guns. China’s Ministry of Science & Technology orchestrated the US$800 million Hou An Innovation Fund to acquire technologies to help its industry semiconductor industry leapfrog. The fund purchased a controlling stake in the world’s leading developer of semiconductor IP blocks. The Ministry of Industry and Information Technology also built a US$31.7 billion war chest, even opening its China Integrated Circuit Industry Investment Fund to foreign investors.

According to Price Waterhouse Coopers, China has gone from 16 integrated circuit design firms in 1990 to 664 in 2014. Chinese wafer production firms tripled over a similar span, and the number of testing and packaging firms has increased by 50 percent. E-commerce giant, Alibaba, acquired in-house capacity to design semiconductors tailored for artificial intelligence in a bid to compete with Microsoft and Google. Baidu, Huawei and other major Chinese firms are also enlisted soldiers in the fight.

Secret weapons

Powerful chips are critical for any industry that relies on collecting, managing and computing with data – and that includes the defense industry. Our most sophisticated defense weapons depend on them. The U.S. Department of Defense has a strategy for “Microelectronics Innovation for National Security and Economic Competitiveness.” The US government has imposed billions in tariffs on imports from China to generate leverage in negotiating an agreement to crackdown on forced technology transfers and theft of intellectual property. But it is also deploying other tools to control US exports of critical technologies, another avenue for China to access US innovation.

The US government has proposed expanding its list of “emerging and foundational technologies” (microprocessors for example) deemed essential to national security that would be subject to licensing under the Export Administration Regulations before US companies could export them. Also under review is the Commerce Control List (CCL) to assess any changes that should be made to controls on items to embargoed destinations, which may include China.

The Commerce and Justice Departments have visibly stepped up enforcement and applied existing authorities in novel ways against Chinese companies that might steal technology. In November last year, the Department of Justice announced it would proactively investigate and prosecute Chinese companies for alleged trade secret theft and economic espionage. The announcement was swiftly followed by an indictment of Fujian Jinhua Integrated Circuit Company, Ltd., a state-owned Chinese semiconductor manufacturer, for alleged crimes related to a conspiracy to possess and convey the stolen trade secrets of Micron Technology, Inc., an American semiconductor company. The Commerce Department added Fujian Jinhua to the list of entities to which US companies cannot sell without obtaining a license.

The United States is not alone in applying policies designed to prevent technology transfer to Chinese companies either through export or acquisition. Taiwan and South Korea have done the same. Foreign firms are also wary of violating US laws. According to Reuters, Japan’s Tokyo Electron, the world’s third-largest supplier of semiconductor manufacturing equipment, announced in June it would not supply to Chinese firms on a US list.

On the front lines

The Administration’s tariff war is leaving almost no industry or product untouched, affecting semiconductors, semiconductor manufacturing equipment, raw materials, printed circuit boards, and a variety of other products in the industry’s supply chain. American semiconductors often criss-cross the globe during production, so US firms might end up paying this import tax on its own product — not to mention the higher costs of tariffs on the consumer products that run on semiconductors.

While supportive of the administration’s goals, the US semiconductor industry has urged a balanced approach that will protect its intellectual assets from theft and preserve US national security while not unduly hamstringing innovation and growth that is in part derived from international collaboration.

Current technologies and methods of fabrication proprietary to incumbent firms keep them in the lead, for now. But in the near future, chips will run on light rather than electricity. Artificial intelligence and quantum computing will be applied to gain computing speed. Breakthroughs like these will determine who are the future industry leaders, and China has an opportunity to gain entry on the ground floor of those frontiers.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).