Published 27 August 2016

One of the most contentious issues in debates over trade is whether trade “kills jobs.” While trade does contribute to job loss and lower earnings, its effect is much smaller than many believe. And those negatives are offset by clear gains, both for the United States and other countries.

The reality is much more complex. Trade agreements aren’t the principal factor to blame for the majority of U.S. job losses or the decline in earnings. While trade does contribute to job loss and lower earnings, its effect is much smaller than many believe. And those negatives are offset by clear gains, both for the United States and other countries. A real debate on trade should look at winners and losers and compare the effects of trade for each.

One of the most contentious issues in debates over trade is whether trade “kills jobs.”

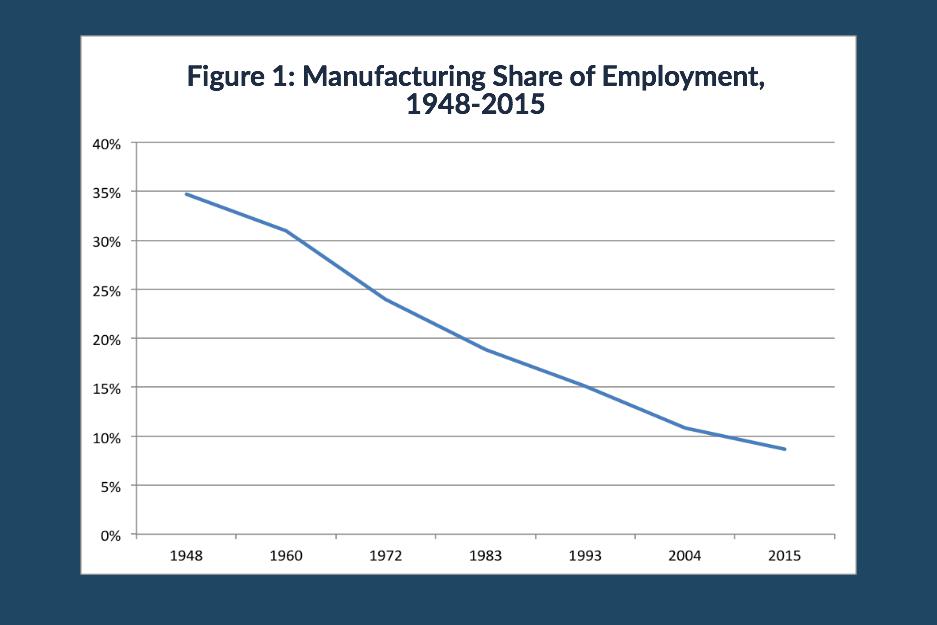

Manufacturing job loss is a good case in point. As Figure 1 shows, the share of employment in manufacturing reached a high of 35 percent in 1948 and declined steadily thereafter.

Source: Bureau of Labor Statistics

After World War II, the General Agreement on Tariffs and Trade went into force on January 1, 1948. In the decades that followed, growth was very strong throughout the most advanced economies. Between 1948 and 1977, the United States ran trade surpluses–its exports were greater than its imports–in almost every year. At the same time, manufacturing as a share of employment dropped by 13 percentage points, which means that trade could not have been responsible for those losses.

In the three decades after WWII, the United States shed manufacturing jobs while running trade surpluses. Trade could not have been responsible for those losses.

In the next 16 years, manufacturing’s share of employment continued to decline and was at 15 percent in 1993, the year NAFTA was signed. This means that three-quarters of the decline in manufacturing since 1948 occurred before the second round of large free trade agreements entered into by the United States. And part of the decline following 1993 seems part of a long-running trend of decline in manufacturing that predated current trade policies.

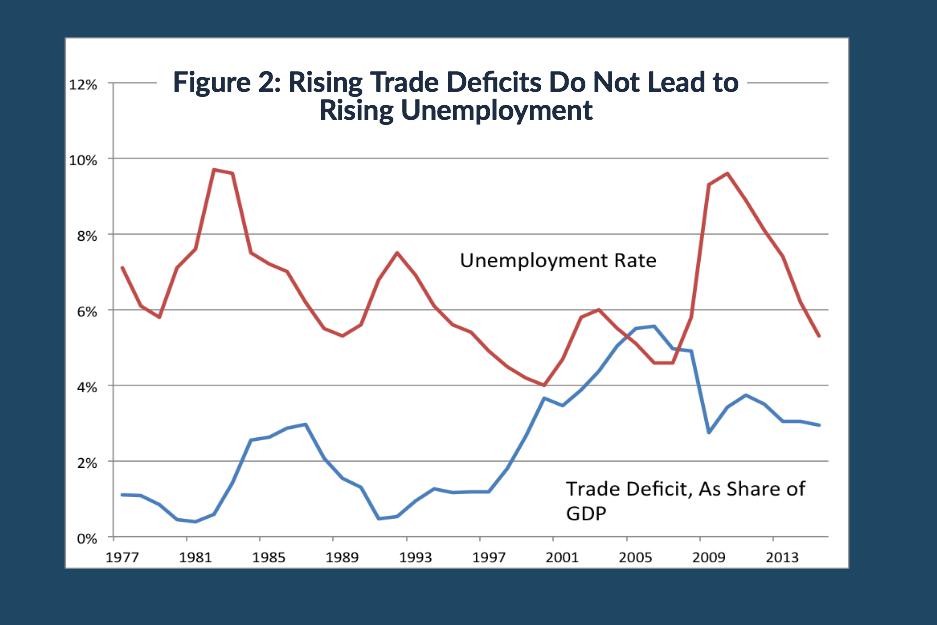

What about the broader labor market? If freer trade harmed the American labor market, rising trade deficits (buying more from abroad than selling goods and services to other countries) should be correlated with rising unemployment. Figure 2 shows the opposite story. For most of the post-NAFTA period, the trade deficit and unemployment have moved in opposite directions.

For most of the post-NAFTA period, the trade deficit and unemployment have moved in opposite directions.

Source: Bureau of Economic Affairs

There is no doubt, however, that trade does lead to some job losses. One study showed that rising trade with China cost America at least two million jobs, and Robert Scott of the pro-labor Economic Policy Institute has found that the net job loss due to trade and currency manipulation could be as high as 5.8 million jobs. On the other hand, Robert Lawrence finds that manufacturing employment without a trade deficit would have been 2.6 to 2.9 million jobs higher in 1998 but that it would have declined by the same six million jobs in the ensuing 12 years. The bottom line is that there are many factors that determine total employment. For example, in the years of the late 1990s, we had rising trade deficits and rising employment (declining unemployment rate).

Trade agreements aren’t the principle factor to blame for the majority of U.S. job losses or the decline in earnings. Many factors that determine total employment.

Critics of trade often downplay the fact that export employment is growing and the fact that the balance of payments (which includes capital movements and capital income) must always be in balance. This means that the trade deficit is offset by a net flow of foreign money moving into our capital market, which has a mild stimulative effect on employment. Consequently, the major employment effect of trade is not that total employment goes down significantly but that particular workers lose their jobs. And since these jobs tend to be concentrated in specific areas, this job loss has wider community effects.

Over the long run, the decline in manufacturing share since 1948 has been driven by productivity growth, which means greater output with fewer workers. Even in more recent years, David Author and coauthors estimate that 80 percent of the decline in manufacturing since 2000 is due to productivity growth and 20 percent due to trade.

Opponents also argue that freer trade depresses earnings among less-skilled workers and leads to rising inequality. It is important to realize that there are many factors other than trade that have also led to rising inequality. For example, Claudia Goldin and Lawrence Katz and a number of other studies show that rising demand for high-skilled workers is the main reason for rising inequality. Other researchers have modified this argument a bit and looked at the ability of computer-driven systems and machines to replace routinized tasks as the basis for job loss and stagnant earnings. Finally, the decline of unionization and the failure of the federal minimum wage to keep up with inflation are also cited as a brake on earnings gains for the bottom half of the earnings distribution.

In a series of papers, Anthony Carnevale and I moved away from a manufacturing-centric approach and defined the high-end service economy as workers in offices, health care and education. In a 2015 study, we showed that the high-end service economy employed 62 percent of all workers, generated 72 percent of all earnings, and employed 81 percent of those with a four-year degree and 91 percent of workers with a graduate degree. Again, rising inequality is tied more to structural changes in the economy rather than trade.

A lot of what is driving employment trends is structural changes in the economy. There are winners and losers, and the best policy would be to find a way to help the losers get back on their feet quickly.

An earlier version of this article appeared in the Washington Monthly.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).