Published 13 June 2023

Biden's decision to restrict the export of advanced chips and associated technologies to China has divided opinions on its impact. But any evaluation will hinge on the outcome of three issues: Whether the loss of the Chinese market will leave US industry less competitive, how China will react, and how badly will the restrictions regime leak?

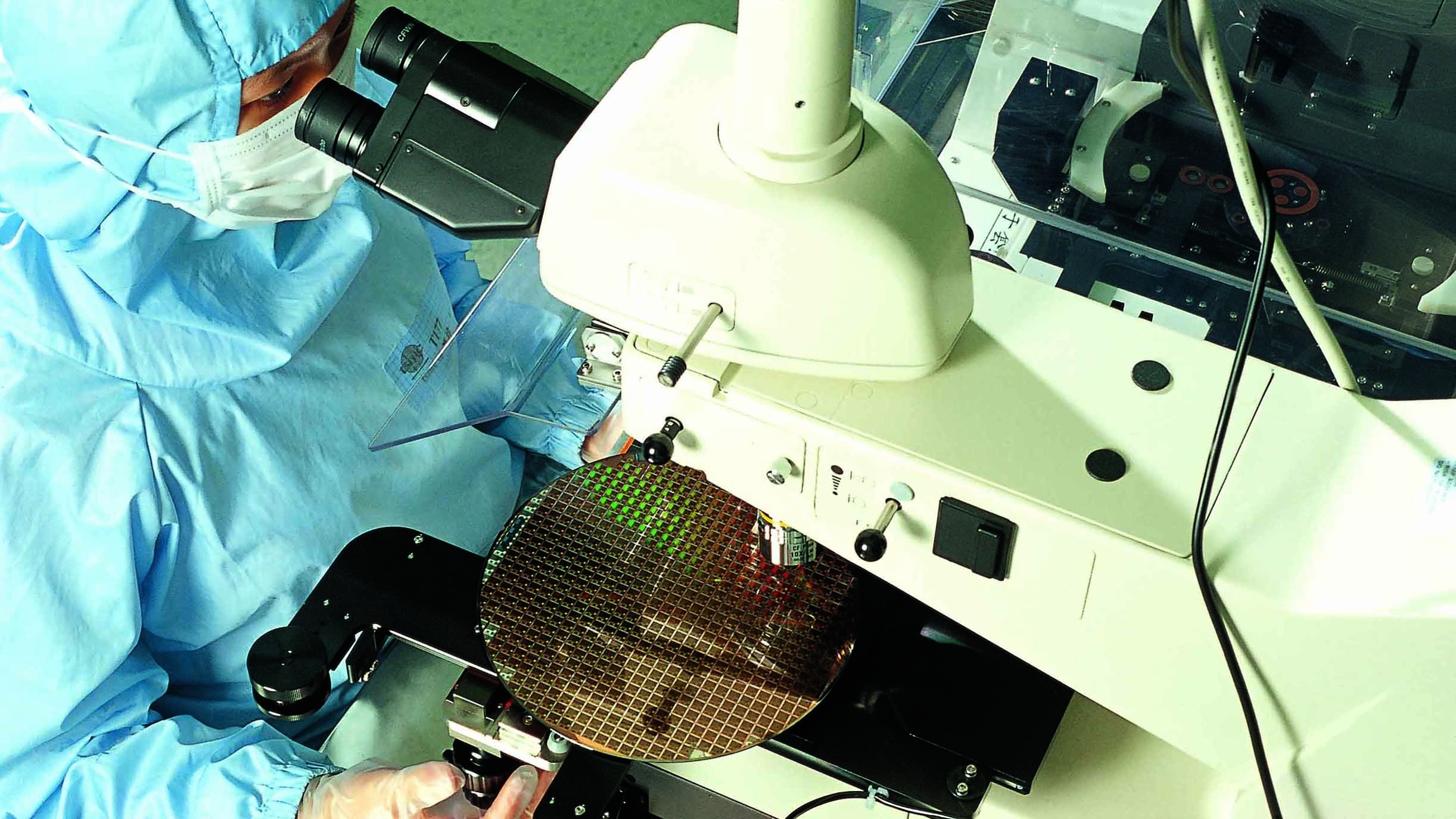

The Biden administration has substantially upped the ante on US efforts to curtail China’s access to US semiconductor technology. In October last year, the US Department of Commerce issued new restrictions on exports to China of advanced chips and an array of sophisticated equipment used to manufacture them. These restrictions go far beyond those put in place by the Trump administration and effectively constitute a chokehold on China’s ability to leap ahead in semiconductor technology.

Exports of US semiconductor design software are also drawn into the suite of controls, and US citizens, residents, and green card holders are banned from working for Chinese semiconductor companies. The new rules are also intended to apply to foreign companies that use US semiconductor technology.

Masterstroke or blunder?

In the view of proponents of the Biden policy, it is a bold masterstroke that will ensure the US is able to stave off China’s bid for technological superiority. In the view of critics, it is an ill-conceived policy destined to do more harm than good to US interests.

We are years away from being able to draw definitive conclusions on the wisdom of the new restrictions, but any evaluation will largely hinge on the outcome of three issues: Will the loss of the Chinese market ultimately leave US industry less competitive, will the restrictions precipitate a damaging counterpunch from China, and how badly will the restrictions regime leak?

During these early days, here’s what we know about each:

Impact on US industry

Producing semiconductors is one of the most difficult and complicated processes in industrial manufacturing. It entails distinct stages – including design, fabrication, testing, and packaging – that no single country can execute at advanced levels entirely within its borders. The US is no longer a major player when it comes to fabrication (although the CHIPS and Science Act aims to change that), but it is a leading player in chip design and the sophisticated tools needed for fabrication, known as semiconductor manufacturing equipment. Taiwan and South Korea have become global leaders in advanced fabrication, and a wider range of countries including China and Singapore has strong testing and packaging capabilities. A constant cycle of feedback and information sharing between the various players sharpens competitiveness and spurs innovation.

Restricting the ability of US companies to service and interact with the Chinese market will have several important implications. On the most obvious level, China is a significant source of revenue for US semiconductor firms. According to the Boston Consulting Group, US semiconductor firms would lose 18% of the global market share and 37% of revenues if they could not do business in China.

While the restrictions will dent revenues and profitability, the greater potential damage to US firms would be a diminished ability to innovate. Revenues fuel investments in critical research and development that is needed to ensure US companies remains industry leaders.

It remains to be seen how significantly the decline in China revenues, along with the accompanying loss of technical interactions, will impinge on the innovative capacity of the US industry, but in the worst case, the US might end up cutting off its nose to spite its face.

Another potentially damaging by-product of the restrictions would be if they spur China to pursue – and ultimately succeed at – expansive “whole of society” efforts to develop indigenous capabilities to replace inaccessible US companies and technologies. China is now doubling down on these efforts in response to US policies. According to Chinese foreign minister Qin Gang, the US-led “blockade” would “only stimulate China’s determination to become self-sufficient”1.

Should these efforts succeed, the US industry will be squaring off against formidable Chinese competitors in global markets in the years to come – competitors that might not have otherwise been quite so formidable if not for the catalyzing impact of the tougher US stance.

It should be noted however that irrespective of the restrictions, China had already committed itself to building indigenous capacity in strategic technologies. The practical effect, therefore, of the US measures could ultimately be an acceleration in the pace and intensity of these efforts.

Will China throw a damaging counterpunch?

Although the rhetoric has grown more pugnacious, China’s substantive response to the US restrictions has been fairly muted. That does not mean, however, that a more forceful response will not be forthcoming. China possesses several points of leverage that could potentially exploit. Raising the “cost” to the US of imposing the restrictions could force a partial rollback or at least discourage additional measures. The challenge for China would be to utilize the leverage without causing unacceptable damage to its interests.

One area where China could inflict retaliatory pain is in rare earth elements (REE). China occupies a preeminent global position, controlling about 90% of the rare earth metals production market. REEs form the backbone of today’s information economy and are the key to the green technologies the world is increasingly turning towards.

Limiting US access to these materials would be highly disruptive, especially given the expansive legislative and regulatory efforts being undertaken by Biden’s administration to hasten the US green transition. But given the deep level of economic integration between the countries, it’s not clear if it could be done in a way that is not overly detrimental to China’s interests.

Another area where China has leverage is the critical importance of its market for US corporate interests. US firms, from small firms to large multinationals, rely on revenues generated by China’s consumer and business market. US Investors and stock markets are by extension heavily reliant on the ability of US companies to make money in China. DuPont, Nike, and Apple are just some of the leading multinationals that have outsized exposure to the Chinese market.

Relying on a host of “behind the border” measures, including safety inspections, denial of licenses, or discovery of an inordinate amount of paperwork “errors”, China has wide regulatory discretion to make life much harder for US companies.

The challenge here is the same as with rare earths: can China exploit this leverage without inflicting as much pain on itself? A carefully targeted approach might work. We could already be seeing the beginnings of such a strategy. China recently banned products made by US semiconductor giant, Micron Technologies, from key Chinese infrastructure projects, citing "serious network security risks”2.

A leaky regime?

The US restrictions will not work if they cannot be effectively implemented and enforced. Given the scale and scope of the US measures, along with their dependence on extraterritorial application, there is good reason to wonder if it will be possible.

Early indications suggest that some artificial intelligence firms in China could be gaining access to restricted technologies through the cloud or by working through intermediaries. China’s explicit policy of civilian-military fusion in which private companies are expected to help the military gain access to critical technologies raises the stakes – and vulnerabilities. The People’s Liberation Army appears to have already successfully used intermediaries to obtain US semiconductors relevant for advanced weapons systems. In any case, it is safe to assume that China is working assiduously to identify and exploit potential points of leakage.

Perhaps the biggest open question is what level of cooperation the US can expect from partner countries in enforcing the restrictions over the long term. Closing the door to the huge China market is a very big “ask” for countries which might not entirely share the US assessment of the threat posed by China’s rising technological capabilities.

Any sanctions regime as expansive as the one the US is currently pursuing will leak. It remains to be seen if the level of leakage can be sufficiently minimized so that the overall objective can be achieved.

For now, reserve judgment

Avoid drawing early conclusions about the effectiveness of US semiconductor restrictions. This is a high-stakes race more akin to a marathon than a sprint, and it will play out over years if not decades.

Perhaps more importantly, ultimate judgments will have to encompass assessments far beyond the realm of semiconductors. The latest US restrictions have implications that will shape the course of the overall relationship. The draconian nature of the US measures, along with their apparent intention to stifle China’s technological advancement, has raised the stakes and significantly intensified the strategic rivalry. Over time, the fallout from this move is likely to bleed into other aspects of the economic relationship, strain geopolitical discourse, and complicate the two countries’ ability to cooperate on global issues. A new, and considerably more fraught, chapter has been opened.

***

[1] China presses Japan to change course on chip export curbs, Financial Times

[2] Micron probe by China seen as chip war retaliation, Asia Times

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).