Published 31 May 2018

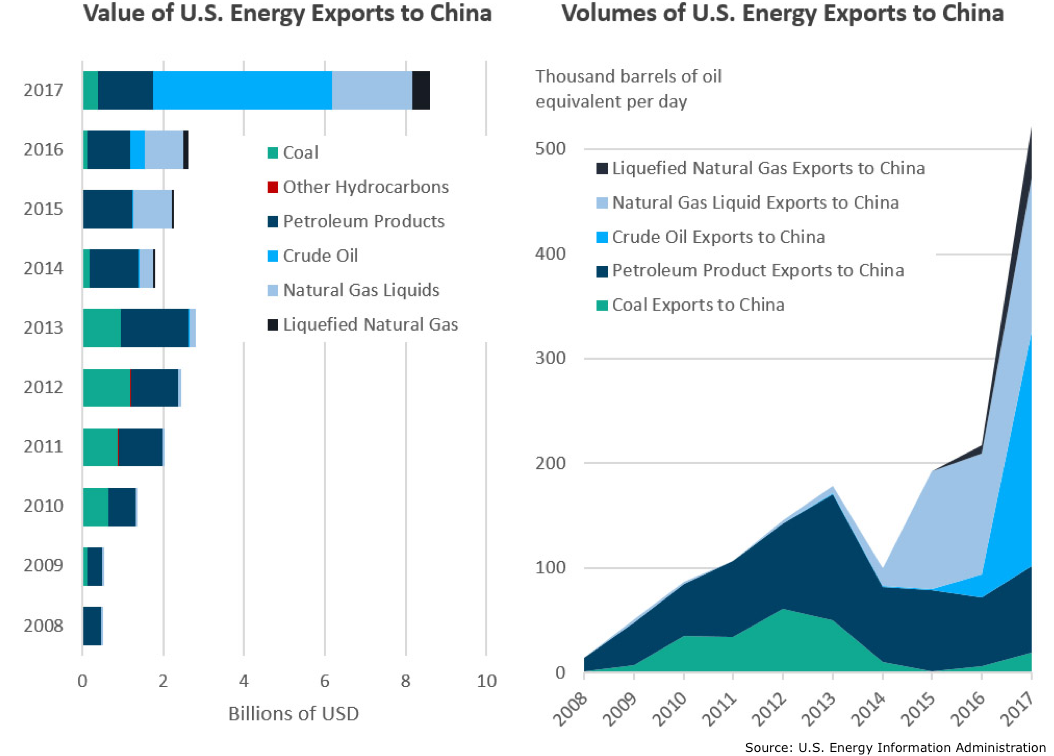

Against a backdrop of high profile trade and investment disputes between the US and China, American hydrocarbon exports to China are booming. US energy commodity exports to China went from US$2.6 billion in 2016 to US$8.6 billion in 2017.

US energy exports to China have spiked

Against a backdrop of high profile trade and investment disputes between the United States and China, American hydrocarbon exports to China are booming. US energy commodity exports to China went from US$2.6 billion in 2016 to US$8.6 billion in 2017. U.S. Treasury Secretary Mnuchin recently stated the United States could “easily get about US$40 or US$50 billion of energy” exports to China.

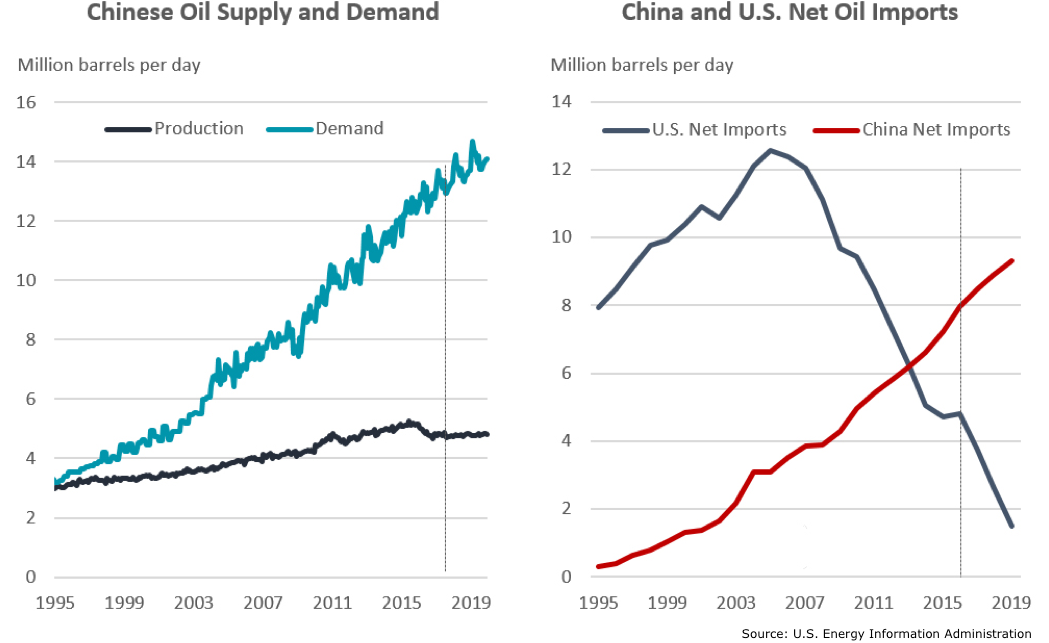

China’s dependence on imported oil is growing

Despite slower economic growth, China’s demand for oil is both increasing and outpacing domestic production. As the Chinese government implements a pledge to reduce coal dependence, Chinese demand for imported natural gas has also grown.

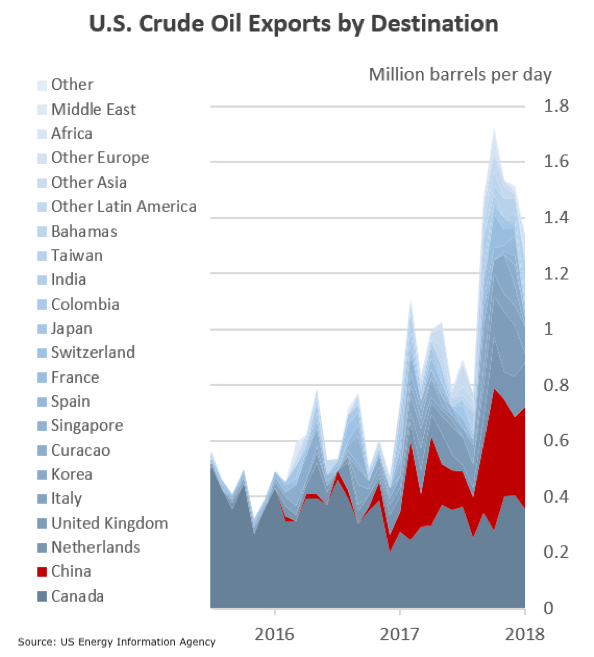

China’s increased appetite is being fed by the renaissance in US oil and gas production. Since the export ban on crude oil was lifted in 2015, US exports have more than doubled, exceeding 1 million barrels per day (mb/d) in 2017. China emerged as a major buyer of US crude in 2017, importing 234 thousand barrels per day (kb/d).

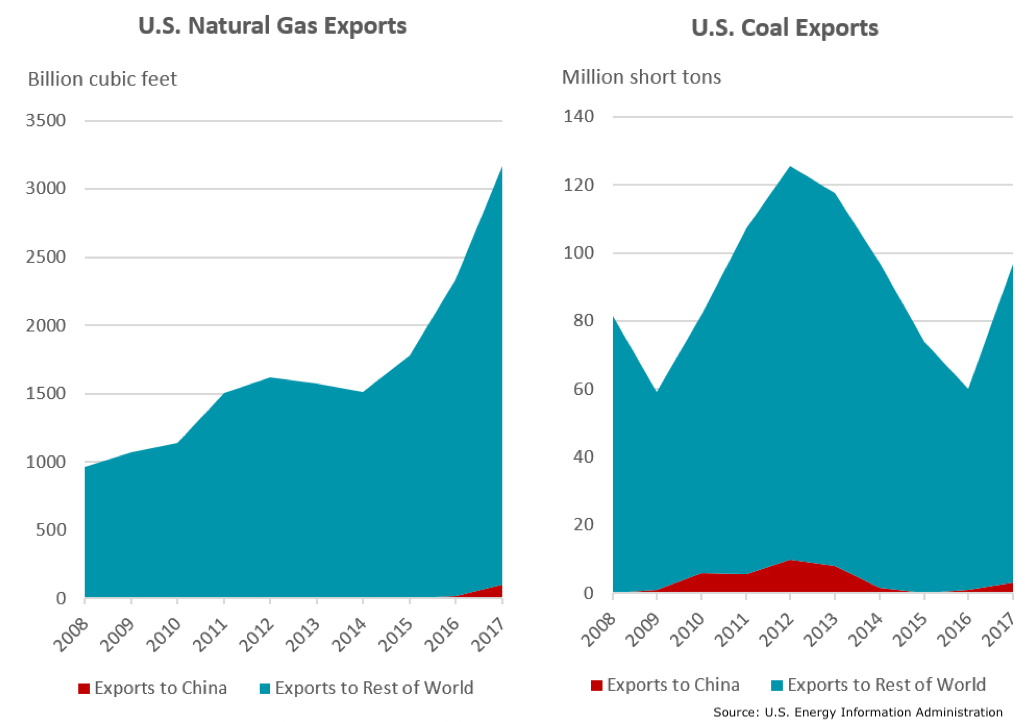

Long-term trade deals are brewing in natural gas

US exports of liquefied natural gas (LNG) are also increasing since Cheniere Energy’s Sabine Pass terminal in Louisiana came online in February 2016. Even with just one terminal online, US LNG exports to China increased from 17.2 billion cubic feet (bcf) in 2016 to 103 bcf in 2017, making China the third-largest destination for US LNG, behind Mexico and South Korea. In February, Cheniere sealed a 25-year sales deal with the China National Petroleum Corp.

The United States continues to expand its liquefaction capacity, bringing at least four additional LNG terminals online by the end of 2019, increasing total capacity to 9.6 bcf per day. Given China’s growing appetite for LNG, many US exporters appear eager to replicate Cheniere’s success. Chinese entities are also looking to invest in the joint development of an LNG export project in Alaska, which would further expand bilateral gas trade ties if a deal materializes.

Growth prospects for US coal to China are less good

The growth margin for US coal exports to China is less clear. When Cyclone Debbie devastated coal mines and a rail system in Australia, disrupting supplies last year, China turned to the United States, among others, to help meet the shortfalls. In the same year, the United States saw its coal exports jump by about 60 percent and exports to Asia more than double.

But China is far from being a leading market for US coal. In fact, China was the 10th-largest recipient of metallurgical and steam coal from the United States, accounting for just 3.3 percent of total US coal exports last year. China has several coal suppliers in close proximity, including Australia, Indonesia, Mongolia, and Russia. Siting export terminals along the US west coast would likely help increase the cost competitiveness of US coal exports to China, but as China works to reduce its coal dependence, the prospects of increasing bilateral trade are unclear.

US energy exports will impact the trade deficit with China

Will energy trade help alleviate the bilateral trade imbalance? The short answer is yes – booming US oil and gas exports to China will contribute to reducing the US bilateral trade deficit.

US energy exports to China increased three-fold in 2017, due primarily to crude oil and natural gas liquids exports, which together contributed 85 percent of the growth in export revenues. The rate of growth of these export values is dependent on market dynamics, including the price of oil, and the extent to which US producers can get their products to market in the face of export constraints.

To an unknown degree, the Chinese government may be directing a surge in Chinese imports of US energy commodities to address the U.S. administration’s complaints about the balance of trade. This is corroborated by a news story from Reuters this week that the Chinese government instructed Sinopec, one of the big three Chinese state-owned oil companies, to boost crude oil imports from the United States.

An export is an export – Does it matter if it goes to China?

In the first quarter of 2018, the United States sold US$3.2 billion worth of energy commodities to China. While the volumes and values of US energy exports to China are expected to continue growing this year, Mr. Mnuchin’s US$40–US$50 billion in sales to China is a still a very long way off.

Is it so important that China buy US oil and gas exports?

US exports, particularly of oil, will flow to global markets regardless of whether China is the buyer—that is, more US barrels to China simply means fewer US barrels to somewhere else. But since China will be buying from somewhere, efforts to direct those sales to US producers represents an easy and low cost way for China to chip away at its bilateral trade surplus with the United States.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).