The conventional drivers of China’s meteoric economic rise are entering an ineluctable decline. As Chinese capital has become less productive, the economy’s structural problems are bound to further inflame global trade tensions.

Since former Premier Wen Jiabao’s 2007 proclamation that China’s economic growth was "unstable, unbalanced, uncoordinated, and unsustainable", China has talked a big game about rebalancing the economy towards domestic consumption. President Xi Jinping’s "common prosperity" campaign and deleveraging of the property sector sparked hopes that Beijing was serious about doing so.

Instead, a political decision has been made to divert capital into manufacturing – another pillar of China’s traditional growth model. The likely result is more industrial overcapacity and the ratcheting up of trade tensions. In strategic sectors favored by Beijing, China’s trading partners will view protective trade measures as being necessary to shield their industrial bases against Chinese overcapacity.

China’s growth engines sputter

Overzealous and ideologically motivated policymaking has undoubtedly contributed to the recent growth deceleration. A case in point was Beijing’s recalcitrant adherence to its zero-Covid policy and refusal to provide any type of substantive income support to affected workers.

Beijing’s crackdown on tech platform companies like Alibaba and Tencent wiped hundreds of billions off market valuations, resulting in substantial layoffs across the sector.

A fixation on such policy overlooks the broader structural forces precipitating China’s slowdown.

Over the past two decades, investment has oscillated between 40%-47% of China’s gross domestic product. Property and infrastructure have each absorbed 30% of this investment. These are all historically unprecedented figures for any major economy.1

When China was underinvested in infrastructure, logistics and housing, this investment was productive, laying an integral foundation for China’s breakneck economic development.

However, as China’s stock of housing and infrastructure rapidly increased, this investment has become divorced from genuine economic needs. The level of non-productive investment has been so extreme that some experts argue up to half of China’s GDP growth in recent years would otherwise be written down as losses in OECD economies.2

These excesses are clearly visible in the infrastructure sector. By 2019 and before subsequent rounds of infrastructure stimulus, China’s stock of public infrastructure was equivalent to 151% of GDP.3 Local governments went to absurd extremes to meet politically determined growth targets. The relatively impoverished southern province of Guizhou is an infamous example, possessing over 1,700 bridges and 11 airports – more than the combined number of airports in Beijing, Shanghai, Shenzhen, and Chongqing.4

As well as coming with a hefty maintenance bill, China’s underutilized infrastructure has caused exponential increases in debt, which is now coming home to roost. Estimates of the debt incurred by local government financing vehicles (LGFV) to fund pet projects range from 50% of GDP to 88% of GDP.5 Concurrently, China’s overall debt has risen to levels exceeding 300% of GDP.

This debt was much more sustainable when local government coffers were flush with cash from land sales.

Beijing’s August 2020 "three red lines" lines policy, which curtailed the ability of highly leveraged developers to access debt, has been criticized for unnecessarily maiming the golden goose. In actuality, the policy was a long overdue, albeit painful attempt at economic readjustment. The level of ensuing economic pain has in fact prompted a series of interventions – mostly in the form of government pressure on banks to extend favorable loans to the ailing sector – which has undercut the policy’s overall consistency.

With the entrenched maxim that housing prices would only ever rise, the sector become an integral part of China’s political economy and one of the most rapid drivers of wealth accumulation in human history. Local governments – which until 2021 routinely derived over 40% of revenue from land sales – households, developers, and suppliers all benefited handsomely.

Despite fitful attempts to rein in the sector, property and related industries grew to consistently encompass around 30% of GDP for much of the last decade. Before the ensuing liquidity crunch in October 2021, new housing starts exceeded demand by 50% as China’s floor space per capita surpassed those in wealthier economies.6

A sector which in 2015 accounted for more than one-fifth of that year’s 7% annual growth figure is now a net drag on GDP growth. Overall activity across the sector has now collapsed by half.7

Efforts at reviving the broad Chinese market are flagging even in Tier 1 cities, as China’s housing bubble slowly but surely deflates. Demographic decline is expected to more than detract from additional demand from (also slowing) urbanization and property upgrades.

With such property and infrastructure oversupply, it is unsurprising that China now must invest US$8 for US$1 of GDP growth gain – twice the level a decade ago.8

The miasma of LGFV debt is inexorably percolating through the financial system toward the central government’s ostensibly healthy balance sheet. Beijing is now leaning on state-owned banks to roll over LGFV debts at reduced interest rates.

China clearly needs new and more sustainable growth drivers.

Will consumption be king?

China currently consumes less than 40% of its GDP, well below the global average of 60%. This figure has not budged much since Wen Jiabao’s 2007 pledge.

The good news is that there is ample scope to increase household consumption, particularly among the almost 900 million Chinese people classified as having low-income status by Organisation for Economic Co-operation and Development standards. Before Covid, consumption consistently accounted for most new growth.

Economists like Peking University professor Michael Pettis have argued that China could, at least theoretically, continue to achieve 4-5% annual growth through increasing consumption by 6-7% annually.

But consumption growth of this magnitude would require a radical re-engineering of China’s political economy. This would entail shifting revenue from the central to local governments, and ultimately transferring money earmarked for indirect and direct business subsidies toward funding parsimonious social services, safety nets, and household incomes.

Xi’s rhetorical emphasis on "common prosperity" and unprecedented concentration of power raised hopes that these reforms were now possible. Some observers even went as far as to argue that Xi had created a "common prosperity cabinet".9

These prognostications now look like a classic case of confirmation bias. Xi has shirked genuinely redistributive reforms whilst actively expressing deep skepticism of "welfarism" and Western-style consumption. In a February 2023 speech later published in August, Xi attacked the idea that China has insufficient demand, arguing that investment is the "true driving force for growth".10

Xi’s preferred solution has been to marshal capital away from property toward manufacturing. The objective is to achieve what the recent Central Economic Work Conference described as a "modern industrial system" – Chinese Communist Party-speak for a self-sufficient economy led by high-tech manufacturing.

Reprising a long-held tradition of piling capital into state-favored sectors, business has acted on notice. In the third quarter of 2023, Chinese banks lent nearly US$700 billion in low-interest loans to manufacturers, a more than nine-fold increase from the same period in 2019.11

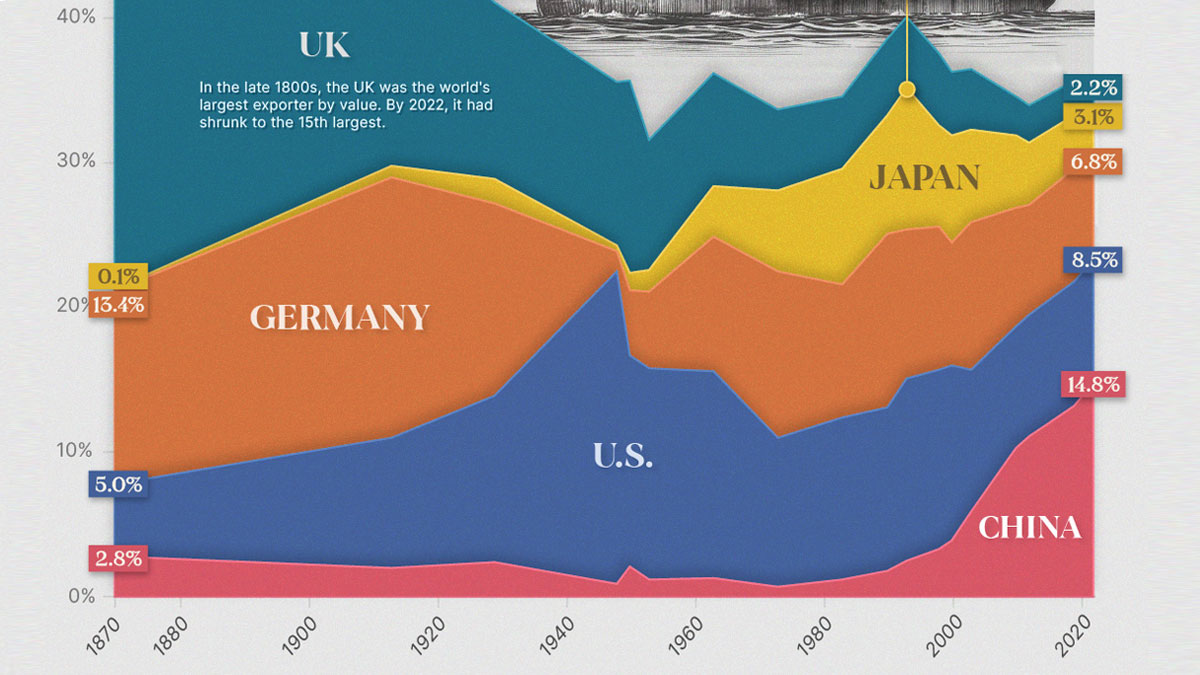

China's share of global exports has soared in the last 30 years. Credit: Visual Capitalist.

China Dream meets China Shock 2.0

All indications suggest that it would be extremely difficult for China to rely on investment and manufacturing to consistently achieve 4-5% growth. Maintaining this growth rate is necessary to achieve Xi’s personal goal of doubling China’s 2020 GDP by 2035.

Pettis demonstrated the implausibility of China maintaining these growth rates through reliance on existing growth drivers. Doing so would require China’s share of global manufacturing and investment to rise from 31% and 33%, respectively, to between 36-39% and 38%. Debt would rise to an incredible 450-500% of GDP.

To absorb China’s excess capacity, the rest of the world would need to actively deindustrialize, allowing their own manufacturing as a share of GDP to decline by 0.5 to 1 percentage points and investment by 1 percentage point.12

This would severely belie the prevailing tenor of the Group of Seven’s current Zeitgeist. Revitalizing manufacturing is viewed as being instrumental to rebuilding the middle class worldwide and on the populist right, as a way of actualizing nostalgic visions of past economic glory.

Nor are these trends confined to the G7. Emerging economies ranging from India, Indonesia, to the Gulf monarchies, all see manufacturing as an integral part of their development. Even traditional commodity producers like Australia, Chile, and Argentina – some of the principal foreign beneficiaries of China’s manufacturing juggernaut – have grand visions for domestic value-add.

Increasingly, interventionist industry policy has also come to be viewed as a necessary protective trade measure against Chinese domination. Whilst China professes free trade and has courted praise for leading free trade agreements like the Regional Comprehensive Economic Partnership, its policy intent is undoubtedly mercantilist.

Chinese officials have at least privately acknowledged that the country has overcapacity across the pharmaceutical, automotive, photovoltaic (PV), lithium battery and electronic equipment manufacturing industries.13 All signs point toward this overcapacity worsening, even if China fails to achieve anywhere near 4%-5% growth.

Overcapacity is particularly pronounced in what China terms the "new energy" sector, which has enjoyed over a decade of government largesse. In the electric vehicle (EV) battery sector, China is projected by 2027 to produce more than four times what it needs to meet domestic demand.14 Average capacity utilization rates at EV factories themselves hovered around 33% during parts of 2023.15

The story is similar in the PV sector, where total capacity reached around 1,000 gigawatts at the end of 2023 – more than twice total global demand.16 Despite huge oversupply, Chinese polysilicon companies like Tongwei Co. are still announcing major investments. Overall, China accounted for 90% of global clean energy spending in 2022, including around 85% for wind turbines.17

These sectors won’t replace previous growth drivers. Goldman Sachs’ analysis suggests that EVs, lithium-ion batteries and renewable energy constitute just 3.5% of China’s GDP.18 Nor is this overcapacity salutary for Chinese industry, with almost all relevant sectors being engaged in, or on the cusp of, brutal price wars. Diminishing profitability will hurt research and development budgets, which are already under strain because of their disproportionate reliance on local government funding.

This will be cold comfort for struggling manufacturers in the G7, particularly in Europe which is more exposed to Chinese exports. As price wars have intensified in sectors like EVs and PV, exports have become a lifeline for beleaguered companies.

Cast in this light, policies like the US’ Inflation Reduction Act (IRA), the EU’s probe into Chinese EVs, and Japan’s package of "economic security" initiatives, look more like defensive trade measures than the wanton recrudescence of protectionism.

In recent months, France, Turkey, and Italy have unveiled incentives or tariffs aimed at protecting local EV manufacturers. India continues to use a combination of tariffs and production-linked incentives to boost domestic production of goods including solar panels, EVs, and active pharmaceutical ingredients (APIs). Expect more of such measures.

Conclusion

The world ex-China’s re-embrace of industry policy will come with severe wastage, costs, and pork barreling.

Prioritizing local production likely means higher costs for both consumers and manufacturers that used to depend on cheaper imported intermediate goods.

In sectors affecting the energy transition, informed trade-offs will have to be struck between maintaining and developing local industrial bases without unduly hampering global decarbonization. The US’ recent decision on Chinese content and ownership, for example, will preclude EVs with virtually any Chinese supply chain footprint benefiting from IRA tax credits. Careful consideration will have to be given to which goods are truly vital to national security and economic health.

At a time when China is aggressively husbanding ever more resources into manufacturing, the usual paeans to free trade appear reckless.

***

[1] Pettis, What will it take for China to grow at 4-5 percent, Carnegie Endowment.

[2] Leng, China’s GDP could be half of reported number, SCMP.

[3] Should China spend more on infrastructure?, The Economist.

[4] Wei & Xie, China’s 40 year boom is over. What comes next?, Wall Street Journal.

[5] Yuxuan & Yang, Part II: Daokui Li on local government debt, The East is Read.

[6] Rogoff, Diminishing returns on real estate threaten economic growth, East Asia Forum.

[7] China property crisis in charts, Bloomberg.

[8] Sharma, China’s economy will not overtake the US, FT.

[9] Lauren Johnston quoted in Nikkei Asia.

[10] Wei & Xie, Communist Party priorities complicate growth revival plans, Wall Street Journal.

[11] Graham, China’s overcapacity threatens global green good trade, Atlantic Council.

[12] Pettis, op.cit.

[13] Di, Will there be a new round of overcapacity reduction in 2024?, Economic Observer.

[14] Dempsey, China battery plant rush raises fears of global squeeze, FT.

[15] Li & White, Chinese electric vehicle groups braced for wave of consolidation, FT.

[16] Xuan & Cheng, Chinese solar firms feel squeeze, Caixin.

[17] Hua & Dvorak, China’s spending on green energy is causing a global glut, Wall Street Journal.

[18] Goldman Sachs study cited in the Wall Street Journal.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).