Published 26 November 2020

How can global tax systems keep up with digitization of the global economy, including where digital taxes should be paid and what portion of profits should be taxed?

Cyber Monday is around the corner when millions of shoppers will hunt for deals online. The fast-paced shift to digital products and services as well as online purchases is fundamentally changing the traditional basis for taxing commercial transactions. It’s no longer as “simple” as conducting a physical sale in one tax jurisdiction.

In response, discussions have heated up internationally, primarily in the Organisation for Economic Cooperation and Development (OECD), on how global tax systems can keep up with digitization of the global economy, including where taxes should be paid and what portion of profits should be taxed, given that companies can achieve global sales without opening a store front, can earn a profit on data moving across borders, and sell products that are not physical (like a video game or an app). Any digital tax would affect sellers and buyers – but also the platforms that enable digital sales, like Amazon.

A digital tax for a digital world

Digitization is dramatically reshaping what we do and how we do it. Many of us are now daily users of social media, e-commerce and cloud-based services. Lawmakers around the world struggle to keep up with the break-neck speed of this digital revolution. One key aspect under global discussion is taxation in this new digital world. In particular, member countries of the OECD have engaged in a broad “international collaboration to end tax avoidance,” which includes an agenda focused on the tax challenges arising from digitization of the global economy.

Digital taxation is a tricky issue, not only because digital transactions are less well defined, but because they often involve the collection and use of customer data, which itself has value. Proponents of digital taxes argue that the data generated by users of social media platforms or other services has financial value, even if the service is free, since the platform provider is generating profit from user data. They believe the tech giants making huge sums of money trading digital services and products avoid billions of dollars in taxes by making use of legal loopholes around trade in digital products and services.

Can’t put the genie back in the digital bottle

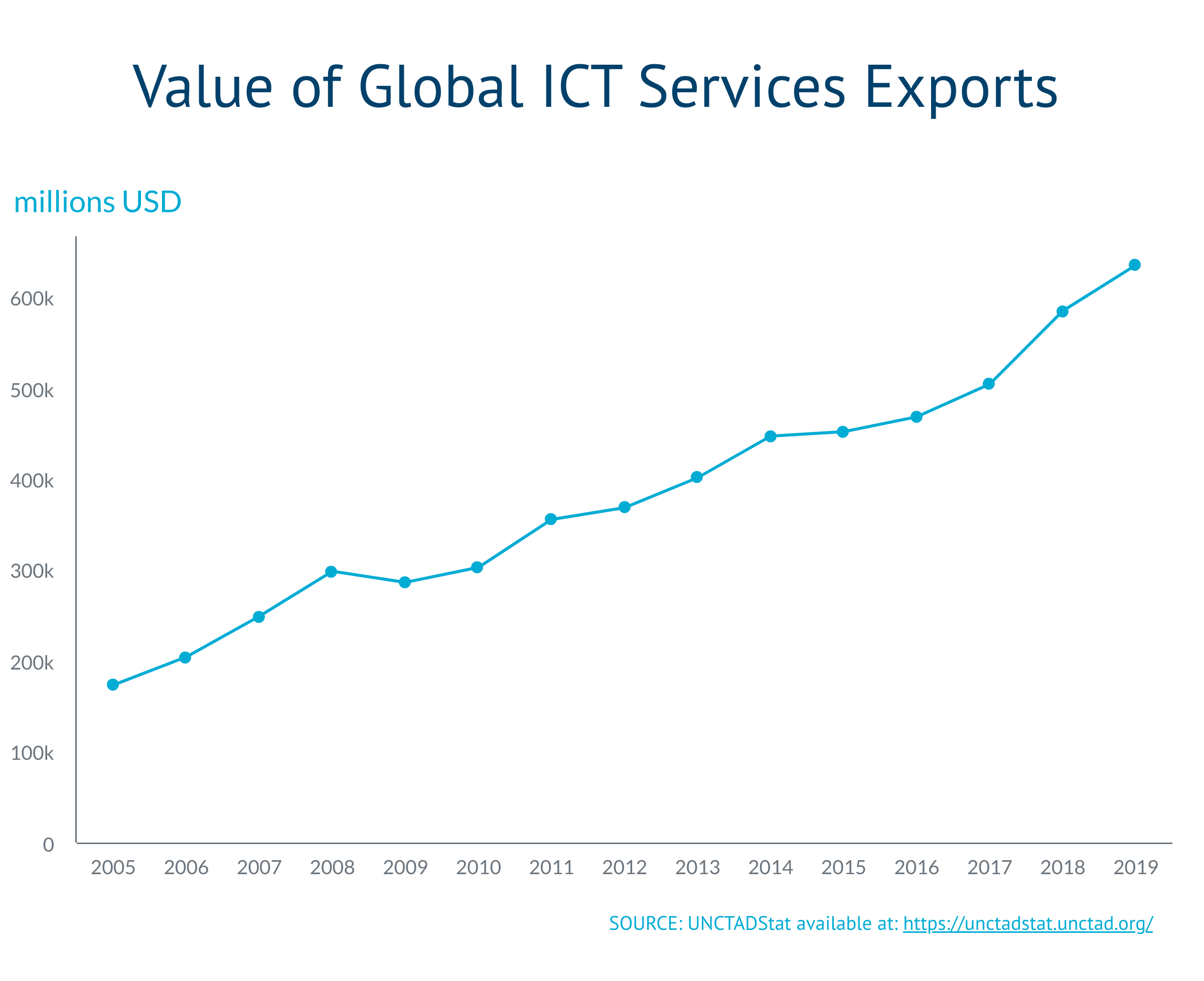

How big is the “digital economy”? It’s not clear because the term is broad and not clearly defined, but one proxy is the measure of exports in the Information Communication Technology (ICT) services sector. Between 2006 and 2019, worldwide exports in the ICT sector more than tripled, from around US$204 billion to over US$635 billion.

Amid a global pandemic when many small businesses are suffering, the global tech giants have prospered. Public pressure on governments has increased to ensure today’s massive, global digital businesses pay more under a clear and internationally agreed set of tax rules. In a recent statement, participants in an OECD meeting on an inclusive tax framework stressed that digital taxes are needed now more than ever to put governments back on stable financial footing after months of unprecedented coronavirus-related public spending.

The pillars on which a digital tax plan can stand

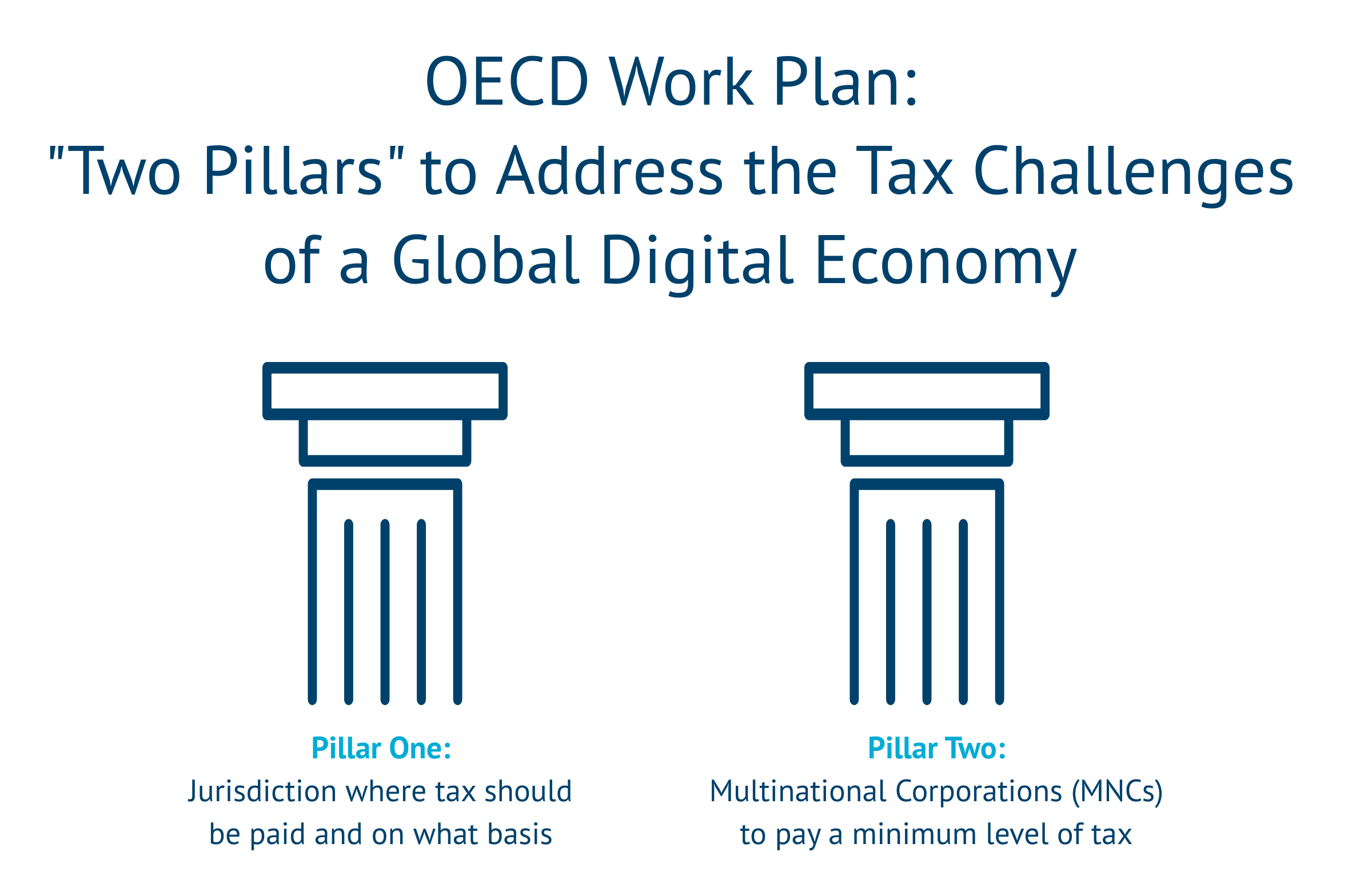

Back in the summer of 2019, the 129 members of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS) adopted a Programme of Work, based on two main pillars, to resolve the tax challenges of the growing digitized economy. Pillar One tackles the question of where taxes should be paid and on what basis. Pillar Two encompasses solutions to “ensure Multinational Corporations (MNCs) pay a minimum level of tax”.

More specifically, the first pillar explores what portion of transactions and profits can or should be taxed in the jurisdiction where the consumer of digital products and services reside, rather than where the producer of the product or service is located. The second pillar is concerned with developing tools that allow countries to require MNCs to pay a minimum level of tax to minimize the ability of MNCs to shift profits to low and no-tax jurisdictions.

Where to next?

Given the level of disagreement among governments and stakeholders on these thorny questions, the original end-of-2020 deadline has been extended to mid-2021. Nonetheless, October saw the release of OECD reports on the Pillar One and Pillar Two blueprints, demonstrating emerging agreement on a number of important issues.

Under Pillar One, participants established a set of building blocks for new rules to permit taxation in a foreign country in the absence of a company’s physical presence. Market jurisdictions would obtain a new taxing right to a share of the profit generated by a business as well as a fixed rate of return for certain marketing and distribution activities taking place in that market jurisdiction. Participants would also establish effective dispute prevention and resolution mechanisms in the name of offering greater tax certainty to businesses. Once the basis of taxation can be agreed, participants will also need to tackle the difficult subject of scope and amount of profit to be reallocated.

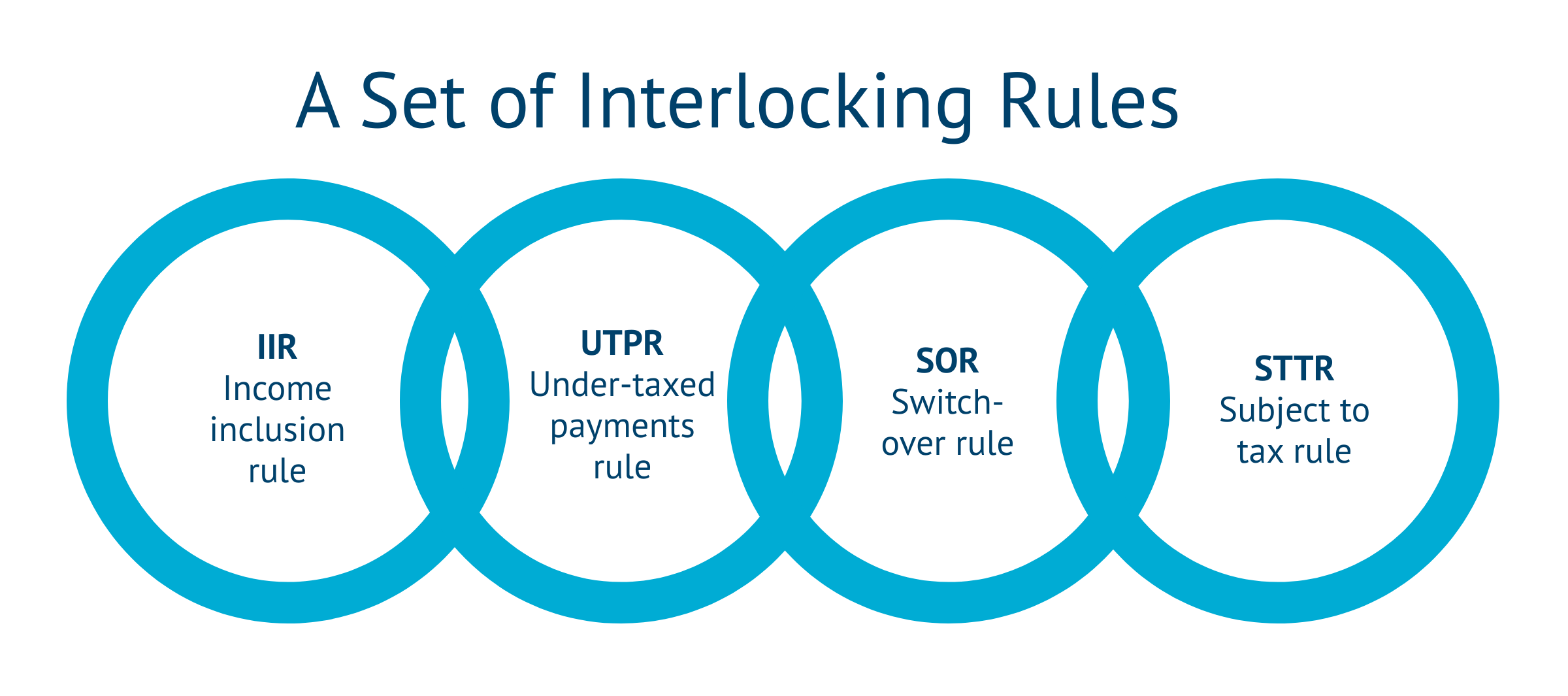

Pillar Two must cope with the differences between national and subnational systems of taxation and business operating models. Whatever approach is agreed to ensuring minimum levels of MNC taxation, it much be transparent, non-discriminatory and not overly burdensome to administer and comply with. Participants have discussed applying a set of interlocking rules. They include:

- Income inclusion rule (IIR), allowing the income of a foreign entity to be taxed if that foreign income is taxed below a minimum rate.

- Under-taxed payments rule (UTPR), acting as a backstop to the IIR, enabling countries to disallow deductions or apply a withholding tax to untaxed or under-taxed payments.

- Switch-over rule (SOR), allowing the changing of tax treaty implications for profits of entities taxed below a minimum rate.

- Subject to tax rule (STTR), where treaty benefits may be changed for items of income where payments are under-taxed relative to a minimum rate.

A Taxing road ahead

Much remains to be hammered out, but the plans have already received criticism from those who believe they will not do enough to bring MNCs to account.

A 2019 report by the Tax Justice Network found the proposed OECD rules could worsen global inequality, leading to a three percent reduction in the tax bases of lower-middle income countries while benefitting rich countries where the MNCs are headquartered. The authors claim that 80 percent of the tax recovered from corporate tax havens would accrue to the wealthiest countries, even though the tax abuses the OECD rules are meant to address disproportionately disadvantage poorer countries, a claim the OECD says ignores vital features of the framework.

The OECD proposals must also clear the hurdle of what is likely to be a long and drawn out political process. The United States in particular has long resisted a global tax regime, butting heads with France over how such rules might be implemented.

With the blueprints released and a public consultation period initiated, multinational companies and advocacy groups alike will have their chance to be heard and influence future action. Whatever is decided will likely have a significant impact on how tech companies choose to operate and how we interact with them, too.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).