US-China trade

Trade war impacts and why a US-China trade deal won't boost the economy

Published 13 January 2020 | 15 minute read

The trade war impacts and lessons learned from imposing tariffs are assessed in this paper, together with the chance that a China-US trade deal can provide a boost to both economies.

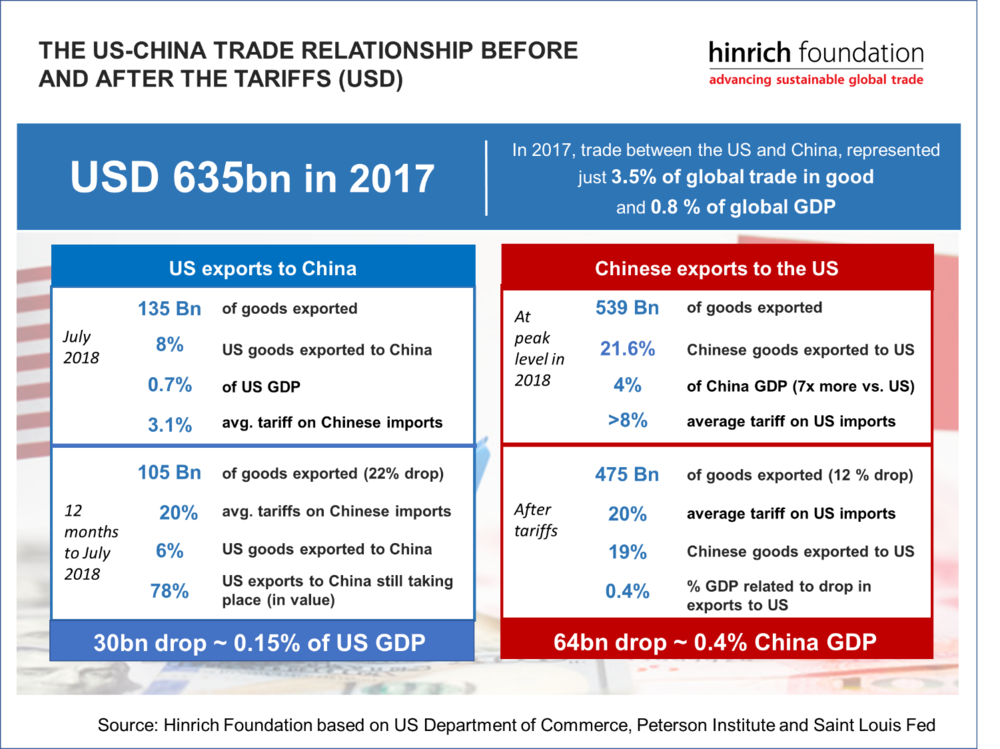

It is now a year and a half since the first salvo of tariffs was introduced in the China-US trade war in July 2018. The US has imposed tariffs on about USD 300bn of Chinese imports taking the weighted average tariff from about 3.1% prior to July 2018 to about 20% now. China’s weighted average tariff on US imports was already high by comparison at over 8% and has risen to about 20% now.

With data through to October 2019, this paper assesses the impact the tariffs have had and seeks to cut through the hyperbole from both disparagers and supporters of the policy. It attempts to quantify the impact, identify lessons that can be learned from America’s attempt to “level the playing field” in its economic relationship with China through the imposition of tariffs, and assess the chance that a Phase 1 trade deal can provide a boost to either economy.

The paper firstly sets out to put the “undisturbed” bilateral trade relationship in context both relative to the participants’ GDP and the global economy. It then quantifies the actual decline in trade and the changes in the trade balance and estimates the potential opportunity cost of the trade war in terms of lost trade. Finally, it looks at employment, wage growth and inflation in the US to ascertain if there is validity in the various claims made by opponents and proponents of the trade war regarding the likely impact of tariffs on economic activity.

The report concludes that the modest detrimental impact of tariffs on the US economy mean that the scope for a phase 1 trade deal to provide a boost to the economy is limited.

Key findings

- Impacts on US exports to China: US goods exports to China have declined about 22% but were of very limited importance to the US economy accounting for just 0.7% of US GDP. The USD 30bn drop in US exports to China accounts for about 0.15% of US GDP.

- Impacts on Chinese exports to the US: Chinese goods exports to the US were about 7 times more significant to China relative to GDP (4% of GDP). The USD 54bn drop in Chinese exports to the US represents 0.4% of Chinese GDP.

- Overall impact on China-US bilateral trade: Despite the trade war, total bilateral trade in goods has dropped by just 12.7% in dollar value terms on a 12-month rolling basis. 7/8th of trade that was taking place in the year to July 2018 has continued despite the tariffs and the rhetoric. In the coming months the drop may become more pronounced and could reach up to 20%. This fall in trade however does not take account of the growth that might otherwise have taken pace. The bilateral trade imbalance is now well below its July 2018 level at USD 369bn. This represents a contraction of 6% (USD 24bn) from the July 2018 level and 12% (USD 49bn) from its peak.

- Impacts on manufacturing: The impact is more pronounced. China-US goods trade is equal to about 5% of global manufacturing value-added. The trade war might well have knocked 0.3% or so off global manufacturing output after taking into account trade diversion. The migration of manufacturing from China and the consequent loss of FDI might have a more debilitating and longer-term impact on Chinese growth.

- Impacts on global economy: US-China trade accounts for less than 1% of global GDP. The deterioration in the relationship has more limited scope to impact the global economy than most reporting suggests.

- Impact on global trade: Bilateral trade was growing and is now shrinking. A simple extrapolating of the trend growth from 2007 to 2017 (which was unsustainably high), implies that trade in 2019 would have been about USD 700bn rather than the likely range of USD 560bn to USD 570bn. Lost bilateral trade does not however translate into lost trade since trade diversion might have made up for about 2/3rds of the short fall.

- Who paid the tariffs? There is little evidence of an inflationary impact on the US economy (or it is being disguised by the general deflationary impact of a global economic slowdown).

- Impacts on US employment? In the eighteen months since the trade war started, employment has grown by 4m or 2.7% in the US. Participation in the work force has risen by 3.6m and unemployment has fallen by another 400K. However, only 165,000 of these new jobs have been created in manufacturing which is where one would expect to find them if they were a consequence of the trade war. Even assuming that each manufacturing job supported 3 non-manufacturing ones, only about 10% of the past trade war employment gains could be attributed to the tariffs.

Impact on US growth and productivity? Any accurate measurement of the impact of the trade war in productivity will likely have to wait several years. In GDP terms though, the US economy has expanded by almost exactly USD 1 trillion since the 2Q 2018 through to 3Q 2019, 20% more than the USD 800bn it expanded in the five quarters leading up to mid-2018.

A sense of proportion: The size of bilateral trade and the tariff rates

US goods exports to China have declined about 22% but were of very limited importance to the US economy accounting for just 0.7% of US GDP.

Lacking from much of commentary around the trade war has been a sense of proportion as to the size of the US-China trade relationship and consequently a realistic assessment of the magnitude of its impact. In the twelve-month period through to July 2018, when the first tariffs were introduced, exports of goods from the United States to China amounted to just USD 135bn. This was about 8% of America’s USD 1.6 trillion of goods exports and just 0.7% of America’s USD 20 trillion GDP. American exports to China peaked in the month tariffs were imposed and in the twelve months to October 2019 they have fallen 22% or USD 30bn to USD 105bn. Consequently, China now accounts for only about 6% of US exports.

The USD 30bn drop in US exports to China accounts for about 0.15% of US GDP.

From a Chinese perspective this flow of goods from the United Sates represented about 1% of GDP. The fact that American exports began to fall immediately on the implementation of tariffs can be interpreted in a number of ways: perhaps American exports were very price elastic or perhaps the Chinese authorities were able to strong-arm buyers to immediately find other sources of supply. Nevertheless, the fact remains that after 15 months of data, the transition in the trade relationship from being accommodative to hostile, $78 of the previous $100 of US exports to China are still taking place. The USD 30bn annual drop in US goods exports to China so far equates to about 0.15% of US GDP.

We should note that using a twelve-month rolling number is the most effective way of stripping out the very pronounced seasonality and short-term volatility in monthly numbers. However, it does result in a lagging number which may not fully reflect the more recent tariff escalation. Therefore, the numbers may well show a further decline in the coming months

Chinese goods exports to the US were about 7 times more significant to China relative to GDP. The USD 54bn drop in Chinese exports to the US represents 0.4% of Chinese GDP.

Unlike US exports to China, Chinese goods exports to the US carried on growing in the early months after the first tariffs were imposed. In the twelve months to July 2018 they totaled USD 529bn, nearly four times the opposite flow. They grew USD 10bn over the next three months while US exports fell. But as alternative sources of supply were found, tariffs were hiked and applied to more goods (it was not until September 2018 that a large proportion of Chinese imports were subject to meaningful tariffs), and stocking came to an end, Chinese goods export to the US began to fall. From the peak of USD 539bn, the 12-month rolling total has now fallen 12% leaving it 10% below the level of July 2018 when tariffs were instigated. At USD 475bn they now stand USD 54bn below their July 2018 level and USD 64bn below their peak level. The USD 54bn annual drop represents about 0.4% of Chinese GDP. At their peak Chinese exports to the US accounted for about 4% of China’s GDP, making them nearly 7 times more significant than US exports to China. The US is a more important market to China in terms of GDP, than China is to the US.

In the global context, US/China trade accounted for less than 1% of global GDP. The deterioration in the relationship has more limited scope to impact the global economy than most reporting suggests.

In a global context the bilateral trade relationship between China and the US is even more insignificant. The USD 635bn of goods trade between the two nations in 2017 represented just 3.5% of global goods trade and just 0.8% of global GDP which stood at USD 81 trillion. These numbers should be borne in mind when assessing the veracity of claims that the US-China trade war has been a “major head-wind” to global growth or that it is the cause of the global slowdown in growth. For example, if 0.8% of global GDP that is bilateral China-US trade were to suffer a 20% decline, and the consequent 0.16% of global GDP were to produce a net economic welfare loss (the deadweight loss) of say 30% after taking into account trade diversion, then 0.05% of global GDP would be lost over a period of perhaps two years.

The bilateral relationship is more meaningful to manufacturing but even then, it is still quite small.

Looking through the lens of manufacturing, rather than GDP, the trade war is more significant. Bilateral goods trade between China and the US is equal to about 5% of global manufacturing value added. US goods exports to China equate to about 6% of American manufacturing value added, while Chinese goods exports to America equate to about 14% of Chinese manufacturing value added. These percentages overstate the importance to the participants to some extent, because the exports will carry an import content (ie. not all the value added will have taken place in the domestic economy). Clearly, any impact from the trade war would be more keenly felt in the manufacturing sector than in the overall economic numbers. It is possible to argue that the trade war might well have knocked 0.3% or so off global manufacturing output after taking into account trade diversion.

Furthermore, remember too that not the entirety of bilateral trade between the two countries has been subjected to tariffs. The US has imposed tariffs on about USD 300bn of Chinese imports taking the weighted average tariff from about 3.1% prior to July 2018 to about 20% now. China’s weighted average tariff on US imports was already high by comparison at over 8% and has risen to about 20% now. Exports from China not subject to tariffs have continued to demonstrate modest growth.

The direct impacts are measurable but manageable

Bilateral trade has shrunk 13% on a 12-month rolling basis and may deteriorate to the tune of about 20% in due course.

What is perhaps most surprising is that, despite a transition from a benign to a hostile trade environment, total bilateral trade between China and the United States in goods has dropped by just 12.7% in dollar value terms on a 12-month rolling basis. In other words, 7/8th of trade that was taking place in the year to July 2018 has continued despite the tariffs and the rhetoric. The rolling number lags, and therefore in the coming months the drop may become more pronounced, but as things stand, it appears unlikely to much exceed 20%.

The bilateral trade imbalance has started to shrink as the Trump administration intended.

The bilateral trade imbalance continued to climb from its July 2018 level of USD 393bn to a high of USD 420bn in the twelve months to December 2018. This certainly called into question the wisdom of the Trump administration’s policy. However, it has since started to shrink quite rapidly and is now well below its July 2018 level at USD 369bn. This represents a contraction of 6% (USD 24bn) from the July 2018 level and 12% (USD 49bn) from its peak. If shrinking the bilateral deficit was the objective, it has started to work and future data will likely confirm this.

The actual fall in trade does not take account of the growth that might otherwise have taken pace.

The relatively small fall in bilateral trade does not, of course, necessarily fully reflect even the direct impact of the trade war. Bilateral trade was growing, and it is now shrinking. While we will never know how much trade would have grown in the second half of 2018 and 2019 if it were not for the trade war, a simple extrapolating of the trend growth from 2007 to 2017, during which time the bilateral trade in goods grew at a compound annual growth rate of 5.2%, implies that trade in 2019 would have been about USD 700bn rather than the likely range of USD 560bn to USD 570bn.

Trade might be about USD 130bn lower than would otherwise be the case. The bilateral deficit might be about USD 50bn smaller than would otherwise have been the case.

Using the same methodology, one could conclude that the missing USD 130-140bn of trade would be composed of US exports to China being about USD 40-50bn higher in 2019 than they currently are and China’s exports to the US being between USD 80-100bn higher in 2019 than they currently are. The deficit would possibly have grown by about USD 25bn as opposed to the actual USD 25bn shrinkage that is now likely.

-…although past growth rates on which those numbers are based may have been unsustainably high.

It is also worth noting, in assessing the opportunity cost of the trade war, that bilateral US-China trade in goods had been growing at about twice the pace of global goods trade in the decade preceding the tariffs. It could be argued that this pace of growth was in itself crowding out other trade – a function of China’s mercantilist approach to exports. It certainly calls into question if that speed of growth would have been sustained in the absence of tariffs and therefore the amount of lost trade calculated by mere extrapolation of past trends probably over-states the number.

Lost bilateral trade does not translate into lost trade since the trade diversion effect might have made up for about 2/3rds of the short fall.

We cannot conclude that the loss in bilateral trade (either actual or theoretical) has translated into the same amount of lost total trade. Trade diversion has clearly been at work, as countries such as Vietnam’s strong export performance testifies. A recent study by UNCTAD concluded that about two-thirds (63%) of lost imports into the US from China in tariffed goods was made up for by imports from third countries. Hence in assessing the loss of economic welfare, if any, that the trade war has inflicted, we must consider the increase in producer surplus that has accrued not only to the US but also third countries.

The migration of manufacturing from China and the consequent loss of FDI might have a more debilitating and longer-term impact on Chinese growth.

If the fall in exports so far has been modest, it does appear as though the trade war has put in place a possibly irreversible trend of manufacturing companies leaving China. This exodus is not something that will likely be limited to a year or two; it takes time and planning to extricate production from a country and move it to another. Furthermore, it seems unlikely that the phase 1 trade deal, with a moderation in tariff rates, will impact this trend. Hence, if one of the objectives of the trade war was to curtail the rise of China’s monopolistic grip on manufacturing – it currently accounts for about 25% of global manufacturing value added – it appears to be working. FDI associated with manufacturing exports has been a key driver of Chinese economic growth. A reversal of this trend could be debilitating to Chinese growth over the longer term.

Who has paid the tariffs, and have they been inflationary?

Tariffs are paid by the importer, but the cost does not necessarily fall on the importer.

Tariffs are paid by the importer, but that does not necessarily mean that the cost falls upon the importer. Nor does the tariff necessarily reflect the full rise in cost. For example, if an exporting company cuts its export prices to compensate for the tariff or part of it, then the cost reduces the exporters margin rather than being inflationary in the importing country. There is some evidence that with a lag, perhaps associated with contract pricing, Chinese export prices are starting to fall as the cost is being passed onto Chinese companies. This was the finding of the UNCTAD report (1) although it is perhaps too soon to conclude categorically that this is happening.

Nor do tariffs necessarily encapsulate the full cost: second choice suppliers may be more expensive.

Equally, if the importer moves to a new tariff-free supplier but at a higher cost, the cost is not reflected in tariff collection but in a higher import cost associated with moving to a second-choice, presumably more expensive, supplier abroad or if the second choice supplier is domestic, it may result in general inflation.

There is little evidence that the tariffs are proving inflationary in aggregate.

The Personal Consumption Expenditure (PCE) price deflator for goods (ie. the index of prices faced by consumers for goods which is where tariff induced inflation should show up), far from rising at an accelerating pace since the tariffs were imposed, has actually been falling. So, too have Chinese producer prices and US import prices – both generally and specifically from China. Therefore, there seems to be little evidence that the tariffs are having an inflationary impact on the US economy or if they are it is being disguised by the general deflationary impact of a global economic slowdown.

It is also worth noting that the tariffs collected by the US treasury have risen from an annual rate of about USD 35bn prior to the trade war to about USD 70b now. The USD 35bn increase, which is larger than the loss of US goods exports to China, is minimal in comparison to the USD 20 trillion US economy and therefore would be unlikely to move the needle much anyway. Tariffs are a tax but there are many other much larger taxes that also potentially produce negative impacts on the economy.

Is the trade war having a debilitating impact on employment and productivity?

The US economy was enjoying a healthy employment situation prior to the initiation of the trade war. One of the dangers of the tariffs was that resources would be diverted from areas in which America enjoys a comparative advantage to areas in which it does not. This loss of efficiency would prove detrimental to productivity and economic efficiency, and therefore growth.

Employment growth since the trade war began has been very robust, especially given the high starting point.

As it turns out employment in the United States has risen dramatically since the trade war started. Using the non-farm payrolls numbers, employment grew by approximately 2.5m or 1.7% in the eighteen months leading up to the tariffs in June 2018. In the eighteen months since the trade war started, from a higher base and with a lower pool of registered unemployed from which to recruit, employment has grown by a staggering 4m or 2.7%. Participation in the work force has risen by 3.6m and unemployment has fallen by another 400K. This strongly suggests that resources are not being diverted away from efficient use to less efficient use, rather it implies that labor was lying idle, not for want of domestic demand, but because net imports were being driven by a surplus of supply or a deficit of demand in the rest of the world. However, only 165,000 of these new jobs have been created in manufacturing which is where one would expect to find them if they were a consequence of the trade war. Even assuming that each manufacturing job supported 3 non-manufacturing ones, only about 10% of the past trade war employment gains could be attributed to the tariffs.

Nominal GDP in the US has continued to expand and at a faster rate.

As more marginal labor is put to work it would be understandable if productivity fell, but there is insufficient data to say if this is happening. What we do know however is that productivity growth has been stagnating since the 2008/9 global financial crisis, long before the trade war was instigated. Any accurate measurement of the impact of the trade war in productivity will likely have to wait several years. In GDP terms though, the US economy has expanded by almost exactly USD 1 trillion since the 2Q 2018 through to 3Q 2019, 20% more than the USD 800bn it expanded in the five quarters leading up to mid-2018.

Conclusion

The modest detrimental impact of tariffs on the US economy mean that the scope for a phase 1 trade deal to provide a boost to the economy is limited.

It is impossible to categorically disentangle the impact of trade war from other factors impacting economic variables. The global cycle was long in the tooth anyway, the output gap created by the global financial crisis had largely closed, and monetary policy has evolved making it even harder to strip out cyclical factors from structural ones. In addition, manufacturing has always been prone to more volatile behavior than the economy as a whole.

Nevertheless, an analysis of the size of bilateral trade in goods between China and the United States relative to their economies and the world and relative to the size of manufacturing suggests that the impact of the tariffs was always likely to be contained and that much of the commentary blaming the tariffs for various outcomes has been exaggerated. It is probably true that the trade war has dented Chinese growth modestly. It is also the case that the overall deterioration in the US-China relationship has accelerated the departure of manufacturing from China and instigated a trend away from dependence on China for global value chains.

It is far from clear, however, that it has been negative for the US economy. The impact on the world economy has probably been negligible with trade diversion offsetting any impact from a slower China. As was the case when the China-US trade relationship was growing, there have probably been distributive effects from the reversal of that trend. Corporate profitability may well have come under pressure from the tariffs and wage earners outside of China may have benefited modestly.

Those who hope that the Phase 1 trade deal will provide a big boost to the global economy are likely to be disappointed on two fronts. Firstly, the deal is unlikely to bring an end to the technological and geopolitical rivalry. Nor is it likely to reverse the trend of diversification of global value chains away from China. Secondly, the negative impact from the trade war has probably been exaggerated and therefore any moderation in its intensity is unlikely to provide the hoped-for boon.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).