US-China trade

China’s dual circulation strategy

Published 12 April 2022

Announced in May 2020, China’s Dual Circulation Strategy (DCS) gives formal substance to several established trends and policies now being pursued by Beijing with renewed vigor. China’s policy shift towards planned allocation over a market driven, growth maximizing allocation of resourced has the potential to divide the global economy.

This page is a compilation of article and essays on Dual Circulation Strategy – also referred to as the Dual Cycle development model. Prepared by the Hinrich Foundation’s research fellows and contributors, the resources explore the impacts of the shift of China’s policy focus on the global economy.

The series asks important questions about the potential implications of this policy change. How will DCS change the way China’s economy engages with the rest of the world? Is China likely to succeed? And how will this approach impact the multilateral trading system and the global economy more generally?

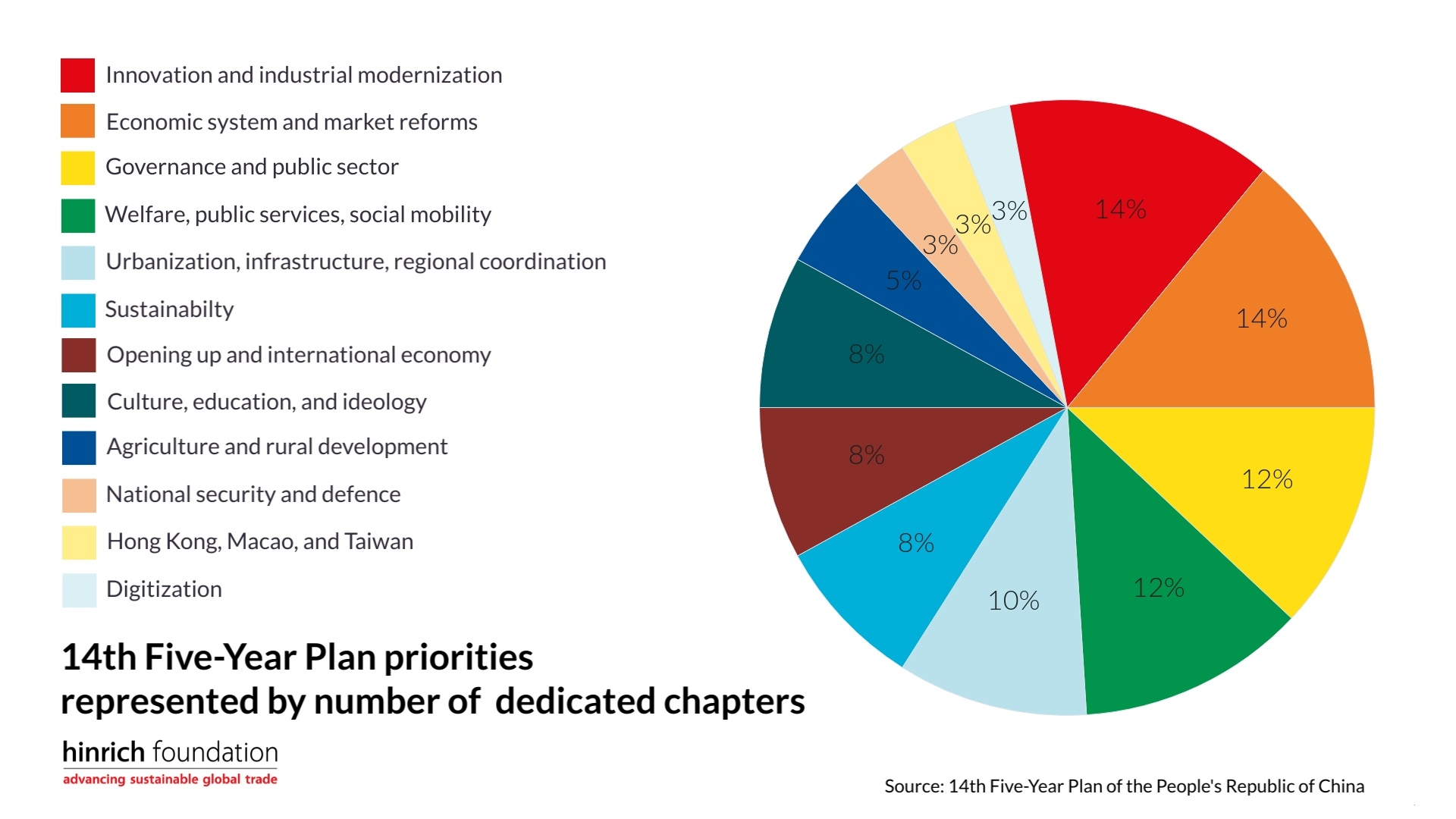

Driven by the twin goals of quality growth and “National Rejuvenation,” instead of high growth or economic efficiency, planned allocation appears to be a priority for the Chinese Communist Party (CCP). China’s 14th Five-Year-Plan dedicates most of its chapters to supporting innovation and industrial modernization (14%) and strengthening domestic socio-economic foundations (14%). These issues have taken precedence over traditional focuses such as infrastructure and urbanization.

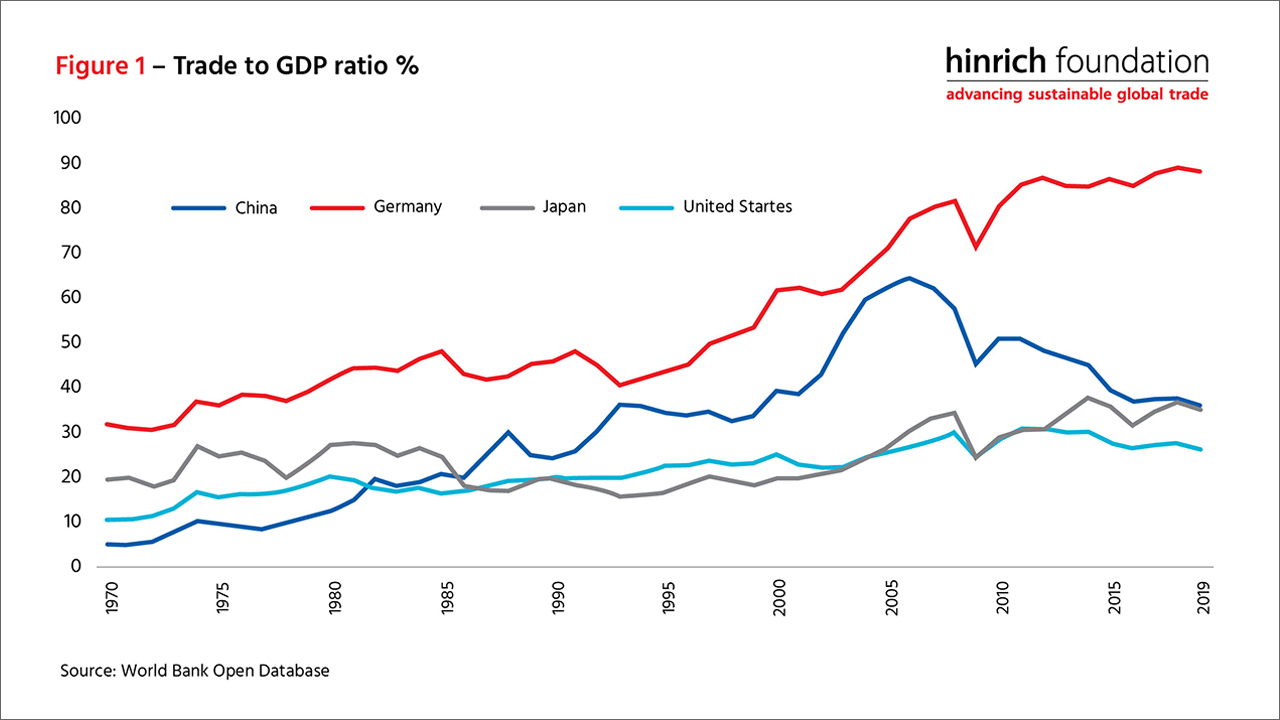

Since the global financial crisis of 2009, China’s economy has grown increasingly dependent on domestic demand for economic growth. Its trade to GDP ratio has continually fallen, and this is a trend that will likely continue. China’s exports and imports have risen slower than its GDP growth, due to the state-led investment model and the boom in residential property development driving the country’s GDP growth. The remarkable degree of dominance of China’s strongest exports also makes further gains in market share more difficult.

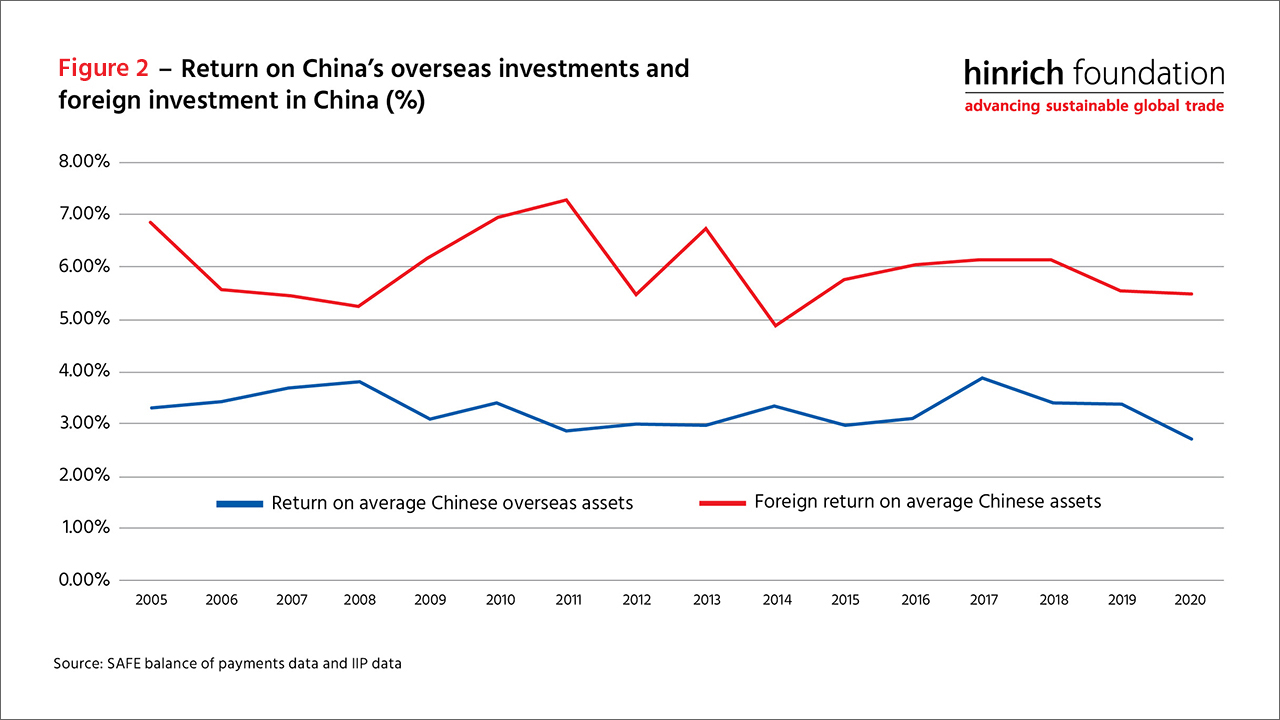

China also earns a far smaller return on its overseas assets than foreigners are earning on their holdings in China. Consequently, China runs an income account deficit despite having a positive international investment position to the tune of over US$2 trillion. It appears much of China’s overseas assets serve a purpose beyond profit maximization. They are national assets to help achieve national rather than economic objectives.

While China's DCS does not necessarily mean the country is lurching to autarky, China is likely to move towards import substitution wherever possible in the pursuit of economic resilience. Such a move will come at a cost, and its ramifications for the global economy, the domestic private sector, and foreign companies in China could prove very far-reaching.

Featured publications:

For, by, and from the Party: Defining the parameters of Dual Circulation

When the phrase Dual Circulation Strategy entered the lexicon of China’s economic policy in May 2020, it was not clear what the strategy might entail. Consequently, substantive commentary about the potential impact of DCS on China’s growth or engagement with the outside world has been scarce. This paper by Research Fellow Stewart Paterson addresses these questions by placing Beijing’s economic planning and policymaking process in the context of the country’s overall political and economic structure.

China’s economic policy of Dual Circulation

The concept of “Dual Circulation” does not imply that China will become a closed economy again, but "Reform and Opening Up" will undoubtedly be less important than in the past. This updated and abridged essay by East Asian Institute Director, Bert Hofman explores the challenge for China and other countries pursuing industrial policies to keep the instruments compatible with an open, market-based international economic system.

How will China’s Dual Circulation Strategy impact the global economy?

China's Dual Circulation Strategy will have a marked impact on the country's international linkages. As China shifts its policy focus from market-driven economic efficiency to planned allocation, driven by the twin goals of quality growth and "National Rejuvenation", bifurcation of the global economy could result. This second report of the DCS series by Research Fellow Stewart Paterson examines the potential consequences of China’s policy on the global trading system.

This Hinrich Trade Educators Center’s course discussion guide will provide educators a resource to lead students in a discussion on the questions posed in Research Fellow Stewart Paterson’s second paper in the Hinrich Foundation series on China’s Dual Circulation Strategy.

China’s ’Dual Cycle’ development model and the digital revolution

Early indications of how Beijing will pursue the dual cycle model in the digital domain are evident in recent, tactical interventions in the domestic market, including the newly implemented Data Security Law and central authority crackdown on ride-sharing firm Didi Chuxing. This paper by Emily de la Bruyère, Senior Fellow at the Foundation for Defense of Democracies, seeks to provide clarity on the concept of the dual cycle and its implications for China’s economy and trade.

Will multinational corporations survive China’s Dual Circulation Strategy?

With its goals of higher quality growth, economic equality, and self-reliance, Dual Circulation Strategy poses a challenge to multinational companies (MNCs) operating in China. This paper by Research Fellow Stewart Paterson explores the future of MNCs operating in China, particularly as it embarks on DCS.

The impact of Dual Circulation Strategy on China’s overseas investments

The international dimension to China's Dual Circulation Strategy can be summarized as the use of the country's domestic savings pool to achieve its geopolitical goals by economic means. This is unlikely to go unchallenged by market economies, and the global trading system will likely suffer further stress as the politicization of every aspect of international economic engagement deepens. The fourth of Research Fellow Stewart Paterson’s series on DCS, this report focuses on the activities of the country's economic actors overseas.

China’s dual circulation strategy: policy shift ahead?

Dual Circulation Strategy should be thought of as the domestic and international economic policies implemented to further President Xi Jinping's over-arching grand strategy towards achieving the “China dream.” However, where the two goals of "national rejuvenation” as defined by Beijing and "economic growth" may conflict, the former now emerges as the priority. In this final report of the Hinrich Foundation Dual Circulation Strategy (DCS) series, Research Fellow Stewart Paterson examines the different scenarios outlining how China’s new policy may evolve over time and the consequences of those developments.

China's "dual circulation" will bring more sustainable trade

China’s dual circulation strategy will bring more sustainable trade despite short term turbulence. The world is not turning its back on trade or globalization, but it is being driven towards a more nuanced approach with a more realistic balance than the previous ‘more is better’ mindset. This article by Hinrich Foundation Senior Research Fellow Stephen Olson looks over a new era in trade brought on by a confluence of factors.

China’s dual circulation strategy signals a new era

China’s leadership has accurately diagnosed a fundamental shift in the external policy environment that enabled the country's economic rise. Through its Dual Circulation Strategy, Beijing seeks greater economic independence while maximising the world’s dependence on China. This article by Senior Research Fellow Stephen Olson explores the implications of DCS that need to be clearly understood by foreign governments and companies.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).