Published 17 December 2020

Textiles, footwear and apparel producers have always faced complicated trading arrangements. In the past, a multi-fiber agreement governed much of the globe and dictated how much of which products could be produced in which markets. This system was dismantled in the 1990s, but protection remains high in many locations.

In addition to often high tariff rates, the rules needed to access key final markets for products can be bewilderingly complex. Lawyers have built entire careers on working with companies to try to sort out the challenges for textile, apparel and footwear firms.

Trade agreements can help address some of the problems for firms trying to move fabrics, t-shirts, ballgowns or basketball shoes. But many existing trade arrangements remain complicated with fragmented rules covering only certain markets and differing rules in other markets.

The upcoming entry into force of the Regional Comprehensive Economic Partnership (RCEP) should be helpful to the textile and apparel sectors. It will make it considerably easier to make fabrics and clothing in Asia and distribute them across the region with lower tariff rates or even duty-free treatment.

Most important, the rules of origin will be consistent around the region. Given the highly integrated supply chains for these products that span multiple RCEP economies, having rules that better fit existing footprints will be especially helpful.

To see how this works, think about a women’s swimsuit. It needs to be able to handle chlorinated and salt water, fit snuggly but not uncomfortably, and have sufficient flexibility in movement to allow swimming, surfing, diving and other water activities.

A swimsuit requires high performance fabrics and sophisticated sewing abilities to make a final product that fits a range of body types and is attractive to buyers.

As a result of these demands, the supply chain for swimsuits often includes the purchase of specialized fabrics from Japan or South Korea, nylon fabrics from Australia or Korea, and sewing skills from China or Vietnam. The global market for swimsuits (disrupted, as with so many things, by the pandemic in 2020) is still expected to reach US$27 billion by 2027, with growth of just over 5% annually.

Existing MFN tariff rates on swimsuits (HS6112) can be quite high across Asia. Australia charges 10% on women’s swimsuits. China’s tariffs are 17.5% for synthetic materials and 16% for other fabrics. Japan has six different categories for swimsuits with base tariffs ranging from 10.9% to 8.4%. Korea levies 13% tariffs. Vietnam charges 20%.

As previous Talking Trade pieces have discussed, RCEP can be a challenging agreement to use and understand for firms. The range of existing trade arrangements between RCEP countries meant that some member governments found it more helpful to create different tariff schedules for some RCEP member states to better accommodate existing tariff levels between parties. In all, there are 37 different tariff schedules that apply to trade in goods in RCEP.

While it will take firms a bit of time to unravel all these arrangements, swimsuit exporters have some significant benefits on offer in the agreement. Australia will continue to be difficult for companies to penetrate, with a 10% tariff that will not become duty-free for RCEP firms until the 20th year of the agreement.

Fortunately, other RCEP economies were less protective of domestic producers. China is rapidly becoming a major market for swimsuits as well as the primary location for global manufacturing. ASEAN firms will see the elimination of the existing 17.5-16% tariffs on the first day of the agreement, or entry into force. It will be reduced across 10 years for Korean exporters into China and in 11 years for Japanese swimwear firms.

All of Japan’s tariffs drop to duty-free by year 15, with two categories of garments with embroidery or lace already duty-free. Korea will grant duty-free access to ASEAN immediately with Chinese swimsuits receiving duty-free access in year 10. Vietnam gave China immediate duty-free access.

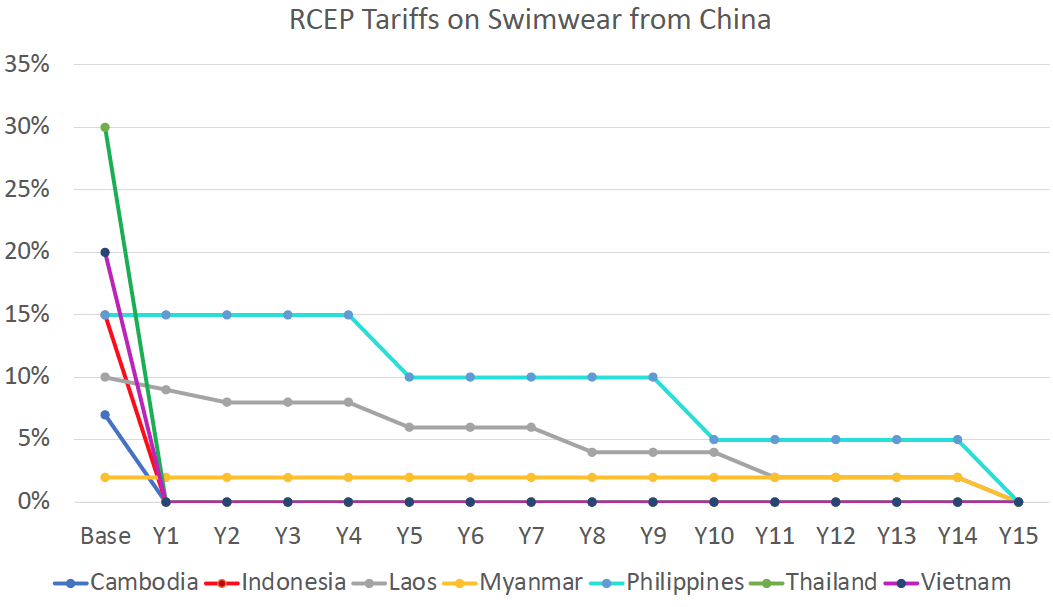

The figure below shows RCEP tariffs in ASEAN for Chinese swimsuits. Note that Brunei, Malaysia and Singapore already provide duty-free access to Chinese suit exports.

Of course, many will argue, some of these tariff “concessions” are already available under a variety of different trade arrangements, such as bilateral free trade deals. Hence the additional, marginal benefits of RCEP for tariff reductions and elimination remains small.

Yes, but… remember the complexity of the supply chains for the production of swimsuits. Even an ASEAN-China FTA, as an example, makes it difficult or impossible to use many of the existing trade arrangements as they may not account for content like flexible fabrics added from Korean or Japanese firms.

The product-specific RCEP rules of origin (ROO), by contrast, can be extremely helpful for firms. RCEP has lots of tariff schedules, but only one rule of origin document that applies to all 15 member states. A product manufactured to RCEP ROOs can be shipped without change into all 15 markets and take advantage of all the tariff benefits on offer.

The RCEP ROO covers all items in Chapter 61 and is quite straightforward: it requires a change in chapter heading (CC). What does this mean? As long as the final swimsuit is manufactured in RCEP to be sent to another RCEP market and undergoes “substantial transformation” in an RCEP market, it can include fabrics, elastics, lace or any other components from any other chapter.

Woven fabrics, including synthetics, can be found in Chapter 54. Hence a woman’s swimsuit (HS61) made of fabrics from HS54, qualifies for RCEP ROOs as the chapter for the product has changed at the two-digit level. While not every textile and apparel chapter or tariff line have CC rules, most products do.

Firms will need to remember that just being manufactured to meet RCEP ROOs is not, by itself, sufficient to qualify for the lower or duty-free treatment granted in the agreement. Companies will need to fill out and apply for benefits using the RCEP Certificate of Origin (CO). The CO document is still under development and will likely be available to firms to fill out both manually and electronically (at least for most RCEP markets).

RCEP is likely to create more market opportunities for swimsuits and other garment manufacturers. The tariff elimination is helpful, but more important is the consistent set of rules needed to qualify for tariff reductions. RCEP better matches existing supply chains for products like women’s swimsuits and should lead to more production in Asia for Asia.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).