Published 22 August 2019

In 1989 when the Berlin Wall fell down, everyone who saw the toppling concrete slabs knew that they were viewing a major event. While it was not clear what might follow the images of people dancing in the streets, it was obvious that the world order had suddenly changed.

The replacement took some time to develop. The early triumphant optimism of an “end to history” or “peace in our time,” eventually gave way to a more nuanced picture.

Economic growth and trade interdependence, however, expanded for most regions and most economies—countries were growing even at double digit rates.

While 2019 is not 1989, it nevertheless has something of a similar feel about it. There is no obvious image to capture the moment when the previous global regimes that have provided structure to societies since World War II have begun to collapse.

The situation is most critical for the economic landscape.

Most commentators are pointing to a fairly technical issue looming in December: the World Trade Organization (WTO) will not have enough judges on the bench to rule on trade disputes in December.

This is important, but not quite like dancing in the streets of Berlin in 1989.

It’s a bit like watching the first piece of the Wall crack and trying to describe falling concrete to someone.

What is actually happening is that the global trade regime will lose its “crown jewel” and no longer be able to enforce the global trade rulebook. It’s as if the referees were being called off the field in a football match. Anything can happen afterwards.

The global trade regime without referees is not really a regime, particularly if the largest players in the system aren’t interested in playing by the rules anymore.

In this slow-motion Berlin Wall moment, the trading system is collapsing.

At the same time, governments are growing less shameless about putting up barriers to trade. The United States is the least subtle about it, with tariffs imposed on hundreds of billions of dollars in imported products from a wide range of countries. Others are also using tariffs and other measures to block the previously free flow of goods and services.

Global trade is undergoing an upheaval as a result. Companies are scrambling to figure out how to respond.

The system that has allowed firms to be multinational and let even tiny companies buy and sell to global customers is under threat.

Trade figures show the impact of disruption. It is not just the continuing tariff war between the United States and China, but an overall slowdown in trade. Technology is a key part of the story, as is the difficulty that firms have in continuing to invest in the face of increasing uncertainty and growing risk.

As the picture starts to fragment, like in 1989, it is unclear what might follow.

But one prediction that is likely to come about is more trade within regions. For Asia, it means redirecting trade away from traditional final markets in the US and Europe and towards greater intra-Asian consumption.

While Asia has been an exporting powerhouse for decades, it has not been particularly focused on buying and selling goods and services to neighbors. This is changing.

One thing that is missing, however, is a structure to manage an evolving economic landscape for Asia.

The existing institutional arrangements do not suit a future order very well. There are only two organizations that might play a role: the Association of Southeast Asian Nations (ASEAN) and Asia-Pacific Economic Cooperation (APEC). The former consists of 10 countries in Southeast Asia while the latter includes 21 members, many of whom are not in Asia.

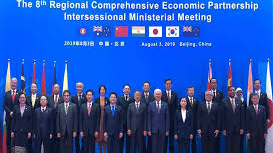

However, 16 countries have spent years working on a trade arrangement for Asia: the Regional Comprehensive Economic Partnership (RCEP). The 16 member governments (Australia, Brunei, Cambodia, China, India, Indonesia, Japan, Laos, Malaysia, Myanmar, New Zealand, the Philippines, Singapore, South Korea, Thailand, and Vietnam) are struggling to complete negotiations on the FTA for November.

The stakes for RCEP are greater than most participants imagine.

If the world is, indeed, watching a new “Berlin Wall” moment, RCEP is likely to become a critically important part of the new world order. It is the only readily available platform for managing trade and economic issues in Asia.

Crafting new institutional structures is always difficult. Doing so in a time of turbulence is more challenging. Hence it is especially important that RCEP member governments seize the opportunity to lock down this trade platform now.

Whatever member governments manage to agree on in November will not be ideal for everyone. This negotiation has always been complex, with diverse membership and divergent demands. But it has become more critical than ever that an RCEP exist by November—Asia will need a mechanism to address trade and economic issues in the region.

Failure to get RCEP done now will be more than a missed opportunity.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).