How to use it

OECD Trade Policy Paper: Raw Materials Critical for the Green Transition

Published 23 May 2023

Raw materials, including metals, minerals, and ores, are critical to building the “green” technologies and systems required for a transition away from dependency on fossil fuels and invite high levels of government intervention. The Organisation for Economic Co-operation and Development (OECD) produced "Raw Materials Critical for the Green Transition: Production, International Trade, and Export Restrictions" to address these issues.

Here’s how to use the OECD Trade Policy Paper: Raw Materials Critical for the Green Transition.

Why is the OECD Trade Policy Paper important?

The OECD Trade Policy Paper defines raw materials critical for the green transition, and where, how, and to what extent these materials are concentrated in terms of production and trade. The paper examines what economies show high dependencies on others for these resources and attempts to measure to what extent and why governments are increasingly restricting exports of these critical raw materials. In doing so, the paper makes the point that growth rates in production are extremely low in comparison to expected demand growth in the coming decades. All this information is important for understanding the current state of play with respect to critical raw materials, and for policymakers and trade negotiators to determine the best course of action for the future, bearing in mind how important access to these materials will be in the fight against catastrophic climate change.

Introduction; Data and concordances

- Renewable energy technologies make more intensive use of minerals than their fossil fuel counterparts; as the green transition progresses, pressures on the production and efficient international exchange of raw materials will intensify; demand for minerals will grow by on average four to six times between 2020 and 2030. (p. 7, Figure 1.1)

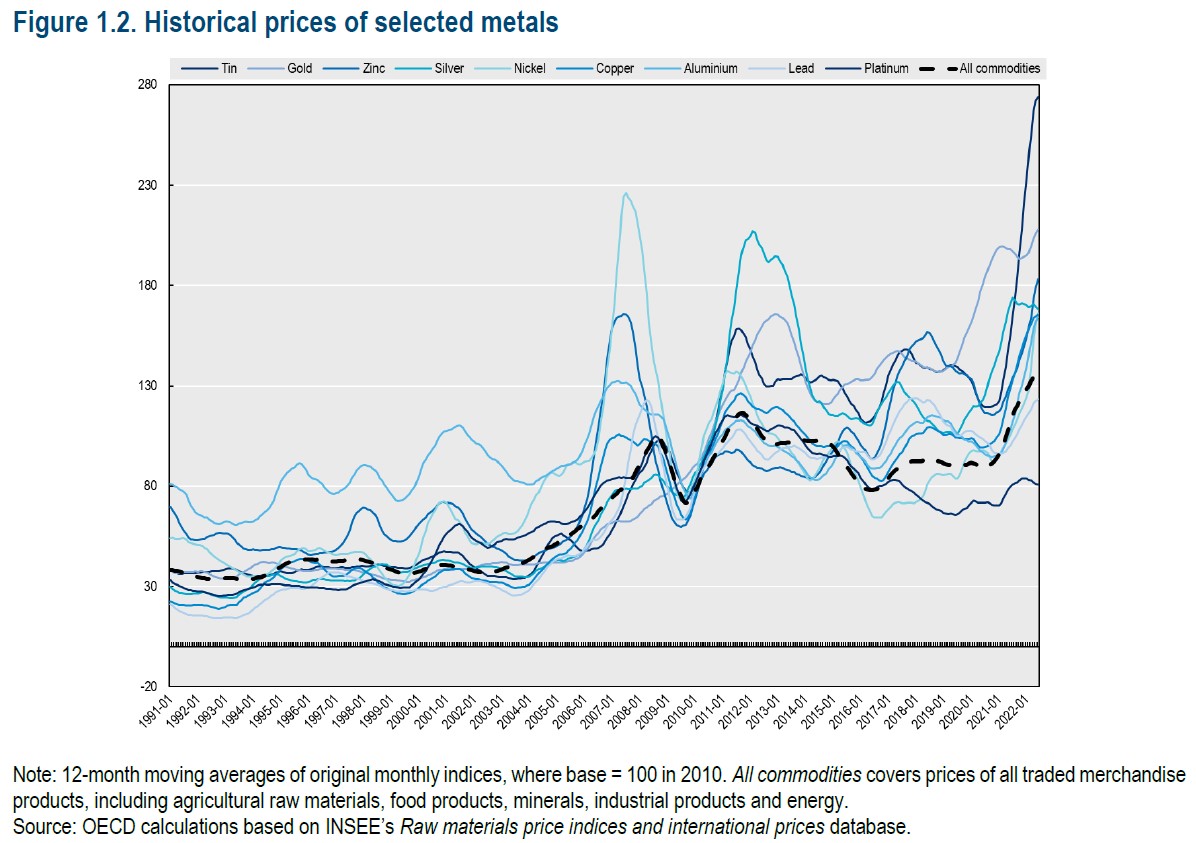

- Prices of many raw materials, including those critical to the green transition (critical raw materials) are at, or close to, historic highs, partially because of consumption and demand patterns driven by the pandemic and the war in Ukraine. (pp. 7-9, Figure 1.2)

- Economies have become more interventionist in terms of the management of such resources, including through export restrictions of raw materials. (pp. 8-9, Figure 1.3)

- “Critical raw materials” are those used intensely in green transition technologies such as li-ion batteries, fuel cells, wind energy, electric traction motors, and photovoltaics; aluminum, copper, and iron ore are the materials used across most technologies. (pp. 11-12, Table 2.1)

Reserves, production, and international trade of critical raw materials

- A key focus is the concentration of production and trade of critical raw materials; extraction of raw materials occurs mainly where these materials are naturally abundant or where natural conditions and available technology make extraction economically viable. (p. 14)

- Mining’s high fixed capital costs make economies of scale significant, resulting in persistent concentration of production and trade even for ubiquitous raw materials; demand is also an important factor. (p. 14, Box 1)

- Global production of critical raw materials increased by 30% from 2012 to 2019 but these growth rates are low compared to the projected increase in demand related to the green transition. (p. 16, Figure 3.3)

- Precious metals and ores, magnesium, lithium, platinum, and cobalt are all highly concentrated and growing in concentration; rare earth elements, natural graphite, other non-ferrous minor metals, and arsenic have relatively high but declining concentrations. (p. 17, Figure 3.4)

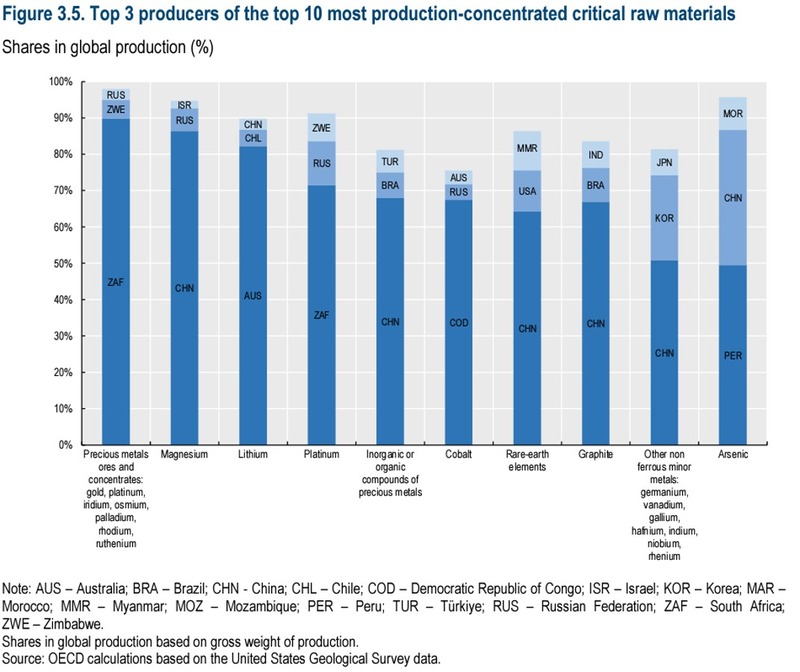

- Production of critical raw materials is concentrated among a few countries, some account for a large share of the production of more than one critical raw materials. (p. 18, Figure 3.5)

- Availability of critical raw materials may depend less on country policies and more on companies that own deposits, invest in mining and processing capacity, meet regulatory standards, and market the materials in international markets. (p. 19, Box 2)

- The top 10 traded critical metals accounted for 94% of the value of global exports of critical raw materials; the trade of ores and minerals has grown faster than the trade of critical raw materials as a whole. (pp. 19-21; Figures 3.6-3.8)

- Imports of products are less concentrated than exports of products generally; for critical raw materials, concentration has increased marginally but consistently for both imports and exports; distinguishing by product and sector reveals some higher concentrations among materials. (p. 22)

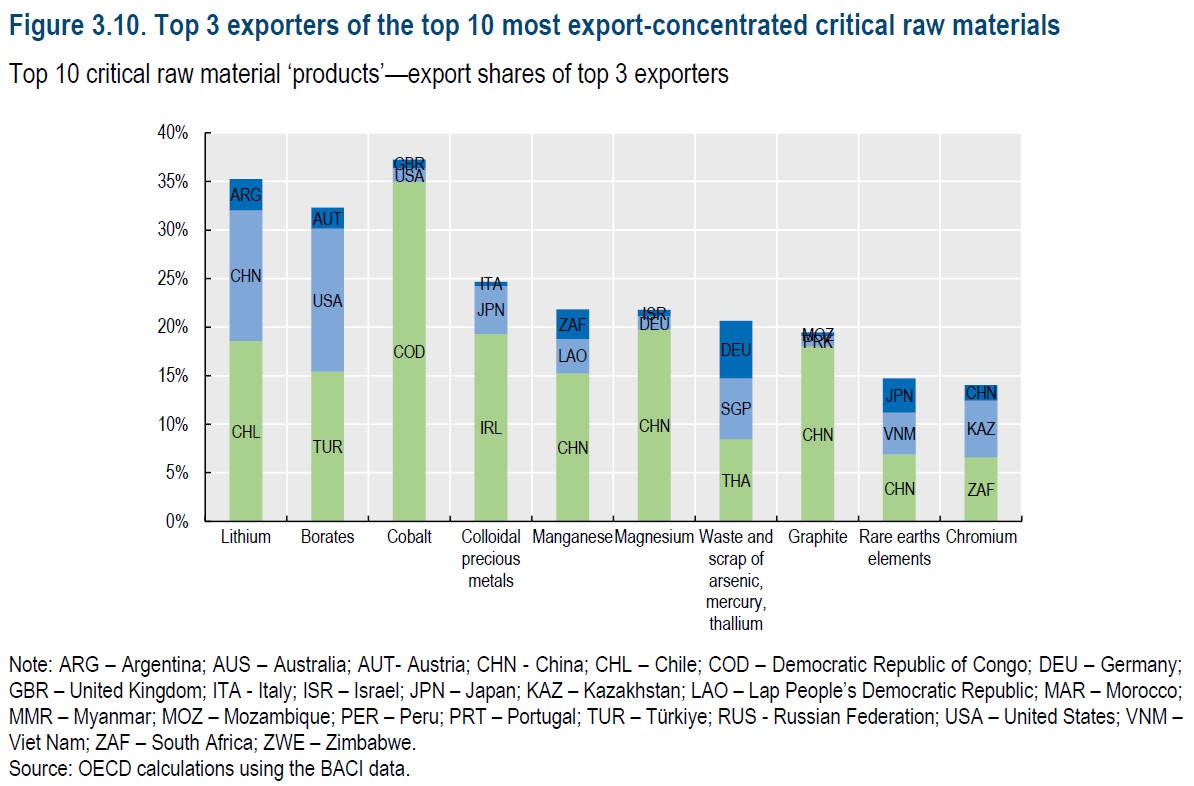

- There is high variation in which countries account for the largest shares of global exports of critical raw materials, linked to natural endowments and production but also economies of scale, size of the national economy, and technology. (pp. 22-24, Figures 3.9 and 3.10)

- For some products, imports are more concentrated than exports, suggesting significant market power of buyers; for some raw materials, major importers have similar levels of economic leverage to key exporters; import concentration, like export concentration, can be a source of disruptions in supply chains. (p. 25)

- While the country concentration of imports and exports of critical raw materials has increased, trade in these materials is diversified; as such, significant disruptions in green transition trade may be limited. (pp. 26-28, Figures 3.11-12, Table 3.2)

- Some importers of critical raw materials depend more significantly on specific suppliers and have fewer diversification options than suggested by average global concentration figures. (p. 28)

- Critical raw materials account for 0.03% of all bilateral merchandise import links but 7% of dependencies of OECD countries on non-OECD suppliers, indicating concentration. (pp. 29-30, Table 3.3, Figure 3.13)

- Critical raw materials are concentrated in terms of countries, with China accounting for 24% of the total, followed by Russia at 10%, Brazil (6%), South Africa (6%), and India (4%); dependencies are not evenly distributed across importing OECD countries (pp. 30-32, Figures 3.14-15)

- Dependencies exist across a range of products but are concentrated heavily around metals like iron and steel, copper, and aluminum, with dependencies concentrated in China, Russia, Brazil, and other BRICS economies. (pp. 32-35, Figures 3.16-18)

Export restrictions on critical raw materials

- As raw materials are mostly used as inputs into other goods, disruptions in supplies can have systemic implications that can be used to justify state intervention in the form of subsidies, export restrictions, and foreign investment controls, and make critical raw materials targets of economic coercion and geopolitical rivalries. (p. 35)

- Subsidies allow domestic downstream users to enjoy lower prices for critical raw materials while disadvantaging foreign producers of a material; export restrictions disadvantage domestic material producers but help domestic downstream users at the expense of foreign users; (pp. 35-36)

- Export taxes on critical raw materials can be used to address environmental or social externalities or to raise tax revenue; raw materials are characterized by high price and volume volatility and their extraction can create significant social and environmental externalities implying the need for regulation and state control. (p. 36)

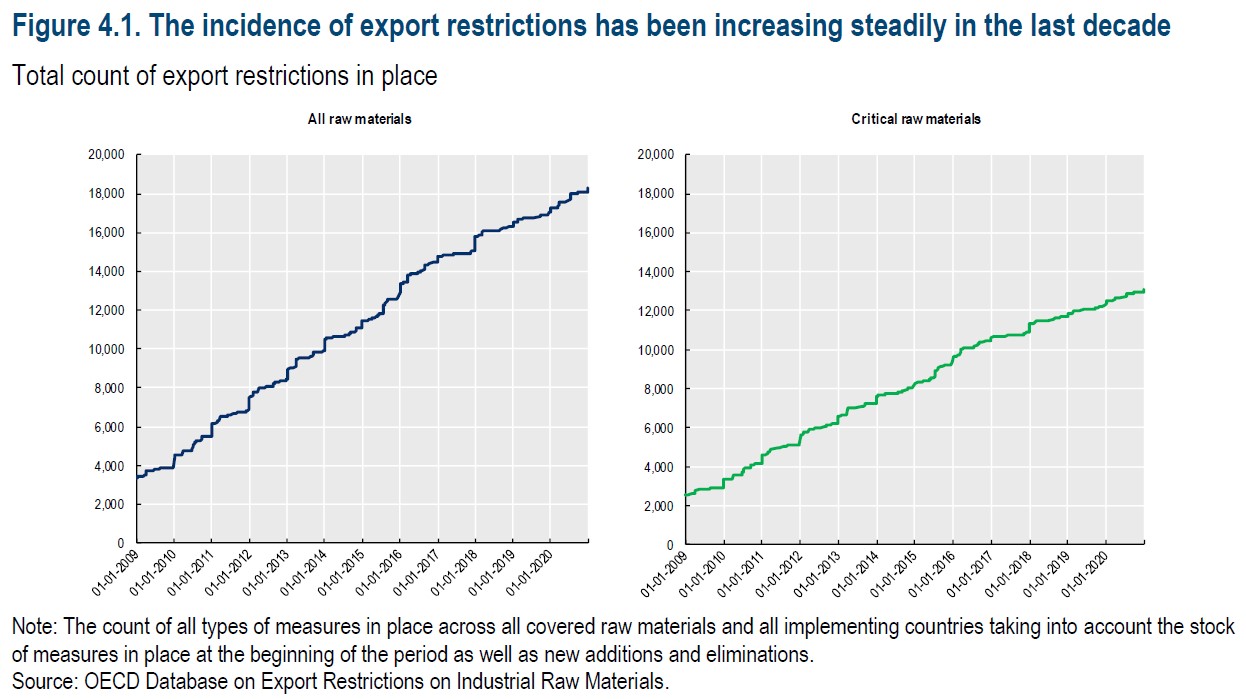

- Export restrictions on all industrial raw materials (in the OECD Inventory) have increased steadily since 2000; from 2009 to 2020 restrictions increased more than five-fold; export restrictions on critical raw materials over the same period have also increased by more than five-fold, but slightly less than for all raw materials. (pp. 36-37, Figure 4.1)

- Some materials face larger increases in restrictions than others; the highest number of restrictions affected waste and scrap sectors; restrictions on ores and minerals grew the fastest; in trade value terms, 10% of the global value of critical raw materials exports faced at least one export restriction. (pp. 38-40, Figures 4.2-4.4)

- China, India, Russia, Argentina, and the Democratic Republic of the Congo had the most export restrictions in 2020; Senegal, Guatemala, Sierra Leone, and Belarus had the largest increases in restrictions; restrictions seem more closely tied to changing attitudes to using them rather than industry or economic factors. (p. 41-42; Figure 4.5)

- The 10 countries that added the most export restrictions since 2009 accounted for 78% of new restrictions globally; the new restrictions by China, India, and Saudi Arabia are concentrated in iron and steel. (pp. 41 and 43; Figure 4.6)

- Export taxes were the most commonly used export restriction in 2020, and accounted for the largest share of the increase from 2009 to 2020, due to growing interest in using export restrictions and the WTO-compliant nature of export taxes; (pp. 43-46, Figures 4.7-4.9)

- For nearly half of export restrictions adopted no reason is given, otherwise the most frequently stated purpose is monitoring and control of export activity, followed by revenue generation, safeguarding domestic supply, promoting further processing, and protecting the local downstream industry. (pp. 46-47, Figure 4.10)

Possible economic impacts; conclusions and implications for future work

- While production of some critical raw materials like lithium, rare earths, and chromium increased in the past decade, production of other critical raw materials like lead, natural graphite, and zinc declined. (p. 47)

- Export restrictions appear to be playing a non-trivial role in international markets for critical raw materials, affecting availability and prices; more rigorous future research and analysis is warranted, though a thorough analysis faces challenges given currently available data. (p. 51)

How to apply the insights

-

These last sections summarize the key points of the analysis in the previous sections. The conclusions highlight the need for a more thorough and rigorous analysis given that the restrictions are clearly significant, although any analysis will face the challenge of relying on the limited data that is currently available.

-

This section could be useful to policymakers and other analysts to understand where to invest in data collection to facilitate required future analysis.

Conclusion

The OECD Trade Policy Paper makes an important contribution to the analysis of production and trade in critical raw materials at a time when focus on these materials is gaining in intensity and the stakes for production, trade, and use of critical raw materials are higher than ever.

Complementary reports and analysis

Hinrich Foundation

- Friend-shoring critical mineral supply chains

- US tries to wean off China’s grip on rare-earth magnets

- Rising copper prices: a sign of economic recovery or market distortion?

External Resources

- Indonesia wants to sell nickel to the US, but first it should scrap its export bans – Peterson Institute for International Economics

For Indonesia to reach a trade agreement with the US, it would have to commit to limiting its use of export bans to force the development of domestic nickel-processing industries and markets. - Rare Earth Reshore – The Wire China

Can the European Union overcome its deep reliance on China’s critical minerals supply chain? - The green revolution will stall without Latin America’s lithium – The Economist

Even as the outside world spies resources in Latin America, governments there are taking back control.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).