How to use it

Interactions between goods and services in international trade

Published 05 December 2023

As goods sold in international trade increasingly incorporate services, trade rulemakers need to consider how existing customs valuation rules and rules of origin address these products and the challenges they present. This policy paper from the Organisation for Economic Co-Operation and Development (OECD) considers whether current rules are sufficient to address products that incorporate goods and services in international trade.

Here’s how to use the report entitled Interactions between goods and services in international trade: Implications for customs valuation and rules of origin.

Why is the policy paper important?

Customs valuation and rules of origin are foundational rules, critical to the functioning of international trade, including assessment of customs duties. Products in international trade that embed or use services as inputs, or where services are sold as part of or to substitute for a good, present a new paradigm that raises questions about whether existing rules are correctly assessing the value of services, and if they are creating new barriers to trade. This paper is important for assessing these questions comprehensively, considering the effect on trade policy goals, and offering a framework for evaluating products that policymakers can use in considering whether to change rules or guidelines.

What’s in the policy paper?

The policy paper includes three principal sections:

Introduction; Goods-services trade configurations: A basic framework

- The landscape of trade configurations involving interactions between goods and services is changing, reflecting higher cross-border tradability of a range of services and their growing role as inputs and outputs across manufacturing production. (p. 5)

- Goods increasingly contain both goods and services or are made with services inputs, include complementary services meant to facilitate the supply or use of goods and to enhance or adapt their functionality; and are services that substitute entirely for goods. (p. 5)

- This landscape presents a challenge for international trade practices and procedures, which are often built on separate rules for goods and services; this paper presents a basic framework with examples to identify and distinguish configurations where goods and services interactions have implications for customs valuation and rules of origin, which should be in line with commercial realities, and not serve as obstacles to the development of business strategies. (pp. 5-6, Annex A)

- Goods-services interactions in international trade do not require a radical restructuring of existing trade law, but policy solutions specific to each type of configuration. (p. 6)

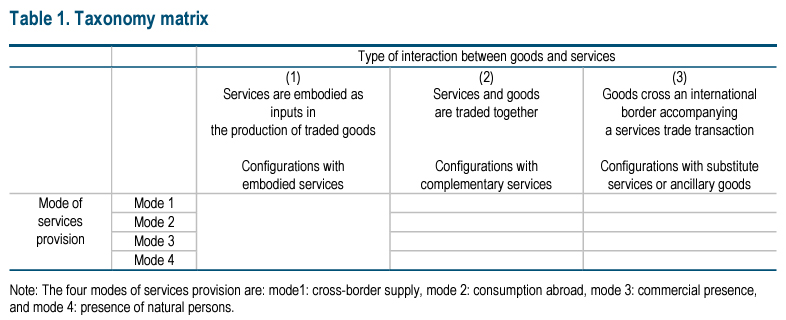

- The framework characterizes trade involving goods and services according to two parameters in a taxonomy matrix – 1) the type of interaction between goods and services, and 2) the mode of provision of traded services. (p. 6, Table 1)

- Column 1 services are embodied as inputs into traded goods but are not directly identifiable in a transaction as they are undertaken and consumed in the production of the good; Column 2 services are traded alongside and are complementary to the good, but distinguished and separated from the good; Column 3 are services accompanied by goods crossing an international border to support supply of the service - only the service is traded as the good is not purchased; this includes substitute services where the service substitutes for the good. (pp. 6-7)

- The mode of services provision in the framework correlates to the four modes of the WTO GATS agreement: mode 1 – cross-border supply, mode 2 – consumption abroad, mode 3 – commercial presences, and mode 4 – the presence of natural persons. (pp. 6-7)

- The matrix partitions the trade landscape into smaller clusters which is helpful as the extent to which goods and services are identifiable and separable is key for customs valuation and origin determination. (pp. 7-8)

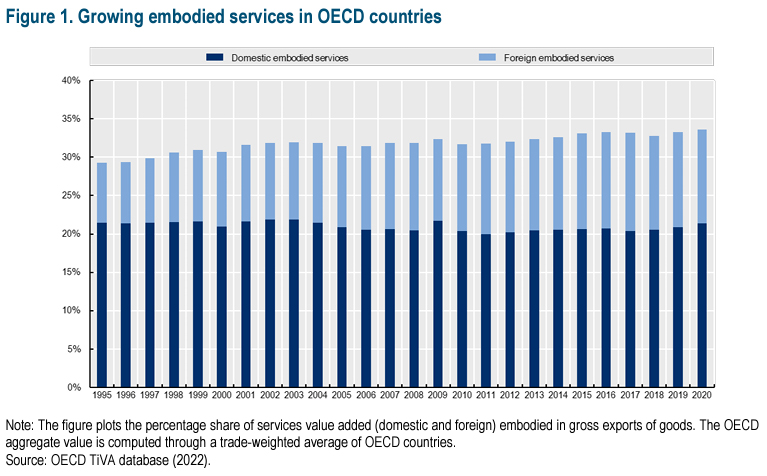

- Goods and services interactions are difficult to capture in statistics, as a collection of data for goods is separate from data for services, and data is lacking; in OECD countries, services embodied as intermediate inputs in goods exports have increased from 29% of the value of gross exports to 34% between 1995 and 2020. (pp. 8-9; Figure 1)

A brief overview of the principles of customs valuation and origin determination

- GATT Article VII has the general principles for an international system of valuation, which determines the tax base to which tariffs are applied and says that the “value for customs purposes of imported goods should be based on the actual value of the good or the price at which…such goods are sold…in the ordinary course of trade under fully competitive conditions”; however, GATT Contracting Parties continue to use varying methods of valuation. (p. 10)

- The 1978 Tokyo Round Valuation Code said that value determination must be based on a fair, uniform, and neutral system that conforms to commercial realities; a cornerstone of the rules is “transaction value” which reflects the full value of traded goods and captures the price actually paid for imported goods; the same rules are in the Customs Valuation Agreement (CVA) that applies to WTO Members; customs valuation rules do not apply to services. (pp. 10-11)

- Origin determination is necessary to identify sources of supply in a transaction and applies equally to goods and services; rules of origin can be preferential – granting enhanced market access opportunities, or non-preferential – used for regulatory purposes. (p. 11)

- Rules of origin (ROO) distinguish between goods entirely produced in a single jurisdiction and those with intermediate inputs or stages of production with more than one source; for the latter, the origin is usually where the “last substantial transformation” took place as determined by (I) a change of tariff heading, (ii) specified manufacturing or processing operations; and (iii) value-added content requirements. (p. 11)

- Under the Agreement on Rules of Origin (ARO) WTO Members can set their own non-preferential ROO following binding ARO principles requiring transparency, consistency, uniformity, impartiality, and reasonableness; for preferential ROO, WTO Members are free to design and implement any methodology; the ROO landscape is fragmented across preferential trade agreements (PTAs) but the rules under the ARO are widely used and recognized. (p. 12)

- Principles and criteria behind ROO for goods do not necessarily apply to services; the intangible nature of services makes the last substantial transformation principle irrelevant or difficult to use; the location where services are performed can be sufficient to determine the ROO for most services traded through consumption abroad (mode 2); for modes 1, 3 and 4, both where the service is performed and origin of the provider are relevant for determining origin; services ROO can also be based on value-added requirements. (pp. 12-13, Box 1)

- Key criteria for services ROO for juridical persons are incorporation/establishment, ownership and/or control, substantive business operations, and employment; for natural persons criteria include nationality, residency, and center of economic interest. (p. 13, Box 1)

- GATS ROO apply by mode of supply and whether the supplier is natural or juridical: for modes 1 and 2, the origin is the jurisdiction from which (cross-border) or in which (consumption abroad) the service is provided; for modes 3 and 4, the origin depends on the origin of the services provider; natural person origin is based on residency or nationality; juridical person origin criteria vary by mode of supply. (pp. 13-14)

Rules, challenges, and policy implications for good-services trade configurations

- Customs valuation is inherently related to the application of customs duties, which generally do not apply to services; the rules and concepts to determine the value of traded goods generally account for the value of services embodied in or complementary to goods. (p. 14)

- Implicitly under the transaction value method, services inputs are included in the value of traded goods, providing a basis for customs valuations of configurations with embodied services, including inputs that require royalties and licensing fees; the CVA provides rules for calculating the costs of inputs or “assists”, including services, when market forces are distorted so that the price paid fails to reflect the true value of the good. (pp. 14-15)

- Trade configurations with embodied services raise a key point of contention, as goods with embodied services are subject to duties while the services themselves if provided alone, would not be subject to duties; goods embodying more services become more expensive as the services increase the value of the good. (p. 15)

- One solution is to deduct the value of embodied services from the price of the final good, but this would incur implementation costs, would be challenging to assess, and could disproportionately advantage more developed economies by making their goods less expensive than developing economies producing goods with fewer services; another option is to reduce tariffs and promote trade facilitation for goods that embody high-value services inputs, which would be easier to implement and have no implications for valuation. (p. 16)

- CVA rules for services assists may need to be adjusted by 1) updating the scope of the list of assists; 2) clarifying for the origin of the service is determined for purposes of excluding services undertaken in the country of importation; 3) considering whether the differential treatment created by the exclusion rule is consistent with CVA objectives; policy actions, including new guidelines from customs agencies, multilateral discussions, and discussions of relevant administrative jurisprudence should be undertaken to reduce uncertainty and ensure alignment of valuation systems. (pp. 16-17)

- Relationships between buyers and sellers and the use of separate services transactions raise questions of whether parties are avoiding duties by selling services under a separate contract when they should be embodied in goods for valuation; one solution is to require more detailed documentation to determine the exact value and nature of services in the good. (p. 17)

- Trade configurations with complementary services involve services that are identifiable and separable from goods and can be traded separately; under CVA principles, if complementary services are a “condition of sale” of the good, even if exchanged separately, their value must be included in the customs value; services undertaken after importation should not be calculated in the customs value; commissions and brokerage, and costs of containers and packing services should be included in the customs value; and transport services up to the port or place of importation may be included if decided by each WTO Member. (p. 18)

- Assessing “condition of sale” is a key challenge; complementarity can range from necessity to non-essential; where services are required by national regulations, complementarity and condition of sale can amplify trade barriers; the timing of a service can have implications for enforcement which increases uncertainty about the application of the rule; transactions between members of the same multinational enterprises and franchise agreements can affect how condition of sale is evaluated considering internal business strategies and terms under which goods and services sales are conducted between members. (p. 19)

- Conducting assessments, considering what complementary services required by regulation can be excluded from customs value, and increasing transparency and accessibility of existing customs rulings and legal decisions can address challenges for providers. (p. 20-21, Box 2)

- In trade configurations with substitute services or ancillary goods, services are the only elements sold and no duties are applied; related goods temporarily move across borders to enable services and are subject to rules on temporary admission of goods for a specific purpose found in the Trade Facilitation Agreement and the ATA or “Temporary Admission” system; broader adoption of the ATA would help to reduce burdens for SMEs. (pp. 21-22, Box 3)

- ROO relevant for goods-services trade configurations depend on what is identified in the transaction; in configurations with embodied services, only the good is traded and ROO follow the wholly obtained or last substantial transformation rule; wholly obtained rules use lists to identify what can be wholly obtained in one jurisdiction; neither wholly obtained ROO nor ROO based on tariff classification changes or specific process requirements consider the origin of embodied services provided for purposes of determining origin. (pp. 22-23)

- Under ROO based on value-added content from a specific jurisdiction, a certain amount of content must be calculated as having come from that jurisdiction; calculation methods are varied and complicated. (pp. 23-24, Box 4)

- Embodied services are not well captured in ROO for goods given tradeoffs between accurate accounting for the origin of inputs and ease of applying ROO for goods; if ROO are revised to better account for embodied services then more complex rules should be accompanied by simpler alternatives; rulemakers should allow for open consultations and timely rule development; and discussions in multilateral fora should take place to harmonize and coordinate rules. (pp. 24-25)

- ROO for configurations with complementary services are the same as ROO for embodied services where the services and goods are sold as one, but where services are treated separately, separate ROO will apply to services and goods; ROO for configurations with substitute services or ancillary goods only apply to services; GATS disciplines provide a framework and some explicit guidelines for services ROO, but WTO Members have discretion to design their preferential ROO. (pp. 25-26)

- Challenges with determining the origin of services under GATS disciplines include lack of robust, consistent, and predictable rules, specifically difficulty in 1) determining the location where services are performed, 2) determining who owns or controls services providers, 3) determining origin in light of multiple providers and where an owner and a performer of the service are of different nationalities; rulemakers should consider economic costs of these challenges and whether they are worth remedying, develop guidelines or standards to correct for defects, promote multilateral discussions to coordinate and harmonize approaches, and increase market openness. (pp. 26-27)

- Goods and services configurations present specific challenges to customs valuation and ROO, increasing the risk that valuation systems and ROO become less effective in achieving trade policy objectives and create barriers to trade; reducing import tariffs can remove some barriers; reducing restrictions to services transactions and harmonizing policy responses multilaterally would facilitate trade and reduce the risk of variability and fragmentation; enhancing transparency and access to jurisprudence would increase predictability. (pp. 27-28, Table 2)

How to apply the insights

- This section does the important work of evaluating each form of goods-services trade configuration and assessing the challenges and risks it presents for current rules, as well as how those risks can or should be addressed.

- It is especially useful for assessing how to make rule changes to address products in international trade combining goods and services.

Conclusion

The Interactions between goods and services in international trade policy paper provides a comprehensive and useful assessment of the nature of trade configurations combining goods and services, the importance of customs valuation and rules of origin and their treatment of these configurations, and the challenges they present and how to address them. This is a useful paper for any rulemaker or trade negotiator considering how to update and improve existing rules.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).