Published 13 September 2018

The implementation of NAFTA has allowed US beef trade to flourish, and the efficient supply chains developed under NAFTA have also helped the US beef industry become more competitive in Asia.

The North American herd

The narrative of complex manufacturing supply chains usually involves products such as automobiles and electronics. In those industries, that various parts and components are manufactured and add value in locations across the globe before reaching the final assembly stage (and the end consumer) is highly visible. But many Americans would be surprised to learn that their hamburger or steak may have followed a cross-border journey before ending up on their grill.

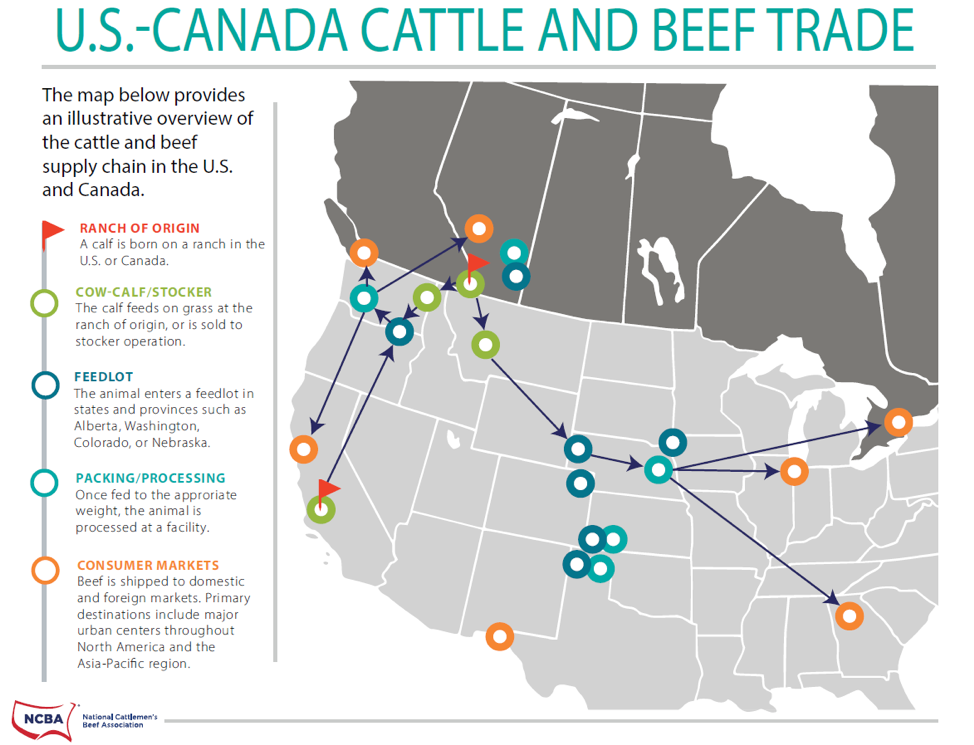

The graphic below illustrates the various ways that beef can go from pasture to plate between Canada and the United States. Live cattle move along each stage of the beef supply chain before ultimately reaching the processing stage and being shipped to consumer markets.

At the beginning of last year, the US beef cattle herd consisted of roughly 80 million head of cattle across all 50 states. That’s many times bigger than Canada’s or Mexico’s beef herds at roughly 10 million and 7 million respectively. But, in many regions of the United States, American farmers and ranchers do bring cattle in from Canada and Mexico to feed before harvesting and processing. And, the U.S. Department of Agriculture reports that Canadian imports of US live cattle reached a 10-year high in 2017, up 370 percent nationwide. (Either way, American corn growers feed a lot of North American cows.) Finally, American producers create value by providing these animals with care and feed before processing.

NAFTA’s no bull

The North American Free Trade Agreement (NAFTA) had a profound impact on the ability of US producers to engage in cross-border cattle and beef trade. Before the agreement was implemented, US producers faced high tariffs (up to 25 percent on some products), arbitrary trade standards, and quotas that set a specific limit on imports and exports. Today producers enjoy unrestricted, duty-free access to Canada and Mexico. Plus, the terms of trade are based on internationally-recognized scientific standards, not the whims of the government.

The implementation of NAFTA has allowed US beef trade to flourish. Overall beef sales to Canada and Mexico add up to roughly US$2 billion annually (a 500 percent increase over pre-NAFTA sales), and these two markets are always in our top five export destinations. US beef accounted for a whopping 94 percent share of Canada’s imports of fresh beef in 2016 and 83 percent of Mexico’s imports.

From top to rump roast

The efficient supply chains developed under NAFTA have also helped the US beef industry become more competitive in Asia. Much of the future growth in beef demand is expected to come from the fast-growing Asia-Pacific region. Japan, South Korea, Hong Kong, and Taiwan represent significant opportunities for US beef. In 2017, these markets accounted for around US$4 billion in sales. The opportunity to sell specialty meats and cuts that Americans don’t prefer to consume means the US beef industry can better maximize the value of every head of cattle. That’s why, from North America to Asia, the US beef industry has a major “steak” in global trade.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).