Trade and geopolitics

The changing shape of trade

Published 21 March 2023

Putin’s war in Ukraine is accelerating disruptions to global trade and investment, with sanctions against Russia taking their toll. Will the standing of the US dollar – integral to trade transactions – be disrupted too and how would the global order be redrawn in the process? Global energy trade has been shaken up by sanctions against Russian oil and gas. Does China stand to profit and how will developments impact trade between China and Russia?

This page is a compilation of resources by the Hinrich Foundation’s research fellows and contributors on the impact of war on global trade. The series addresses issues that are changing the shape of cross-border trade, from the fissures in global energy flows to the vulnerabilities faced by the US dollar. Read the articles in the series to learn more.

Is China's renminbi well placed to bring an end to the dollar standard? Short of disrupting the standing of the US dollar, China will almost certainly gain economically from Russia’s invasion of Ukraine, at least in the short term.

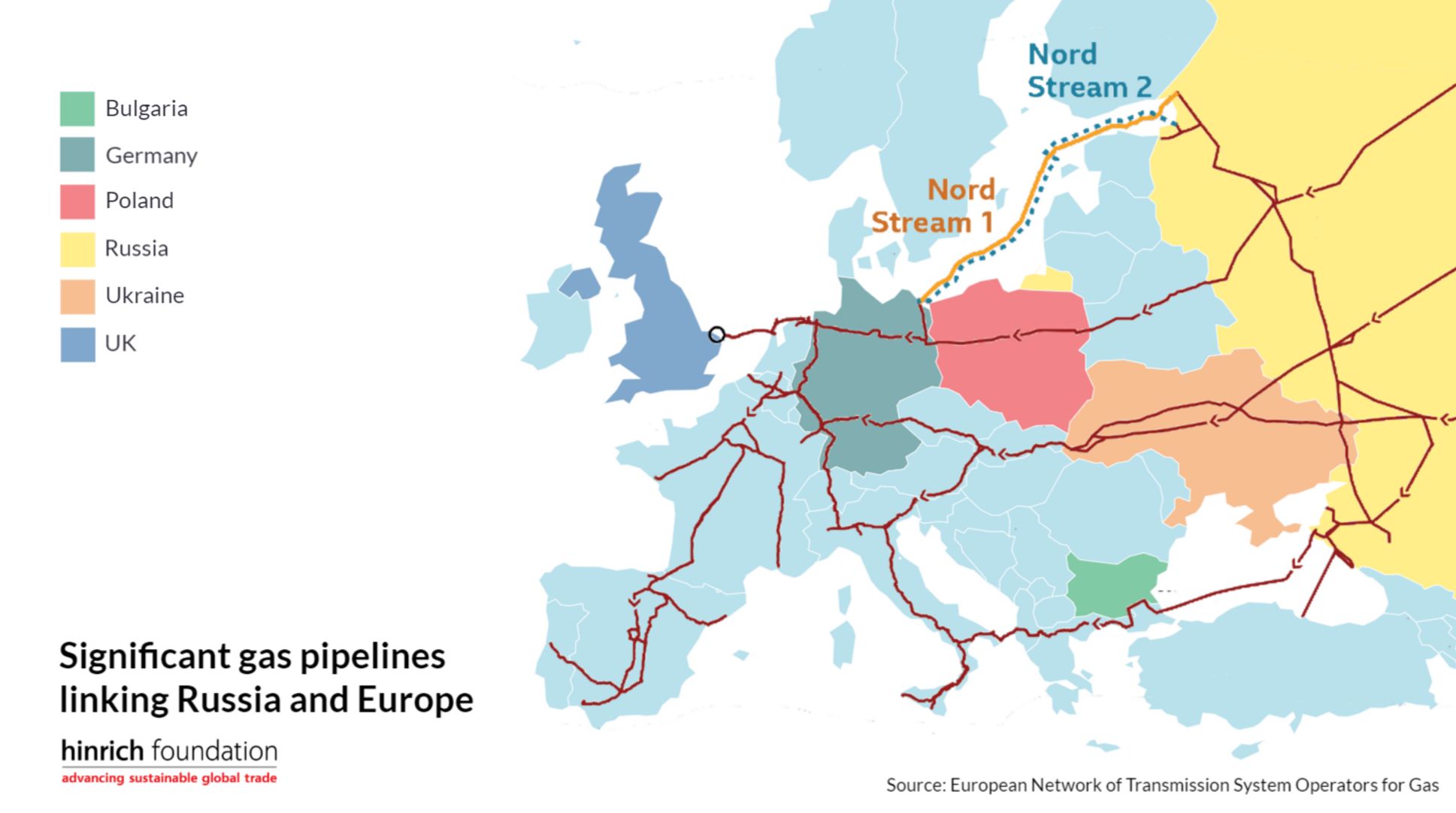

With respect to efforts by the EU and Russia to reorientate their energy trade patterns to break a mutual dependency, Russia is likely to look east to energy-hungry economies in Asia, and China in particular. This trade dynamic could reward Beijing with considerable leverage over Moscow. However, the resulting global upheaval will force China to navigate a considerably more challenging external environment if it is to continue its economic rise.

(Data source: European Network of Transmission System Operators for Gas)

Featured articles:

All eyes on geopolitical uncertainty

Global trade creates greater interdependence through mutually reinforcing economic growth and development. However, increasing global geopolitical uncertainty is weighing on the broad economic outlook and international trade relationships. We asked data artists Visual Capitalist to capture the varying levels of geopolitical uncertainties among economies, part of the indicators measured in the Hinrich-IMD Sustainable Trade Index 2022.

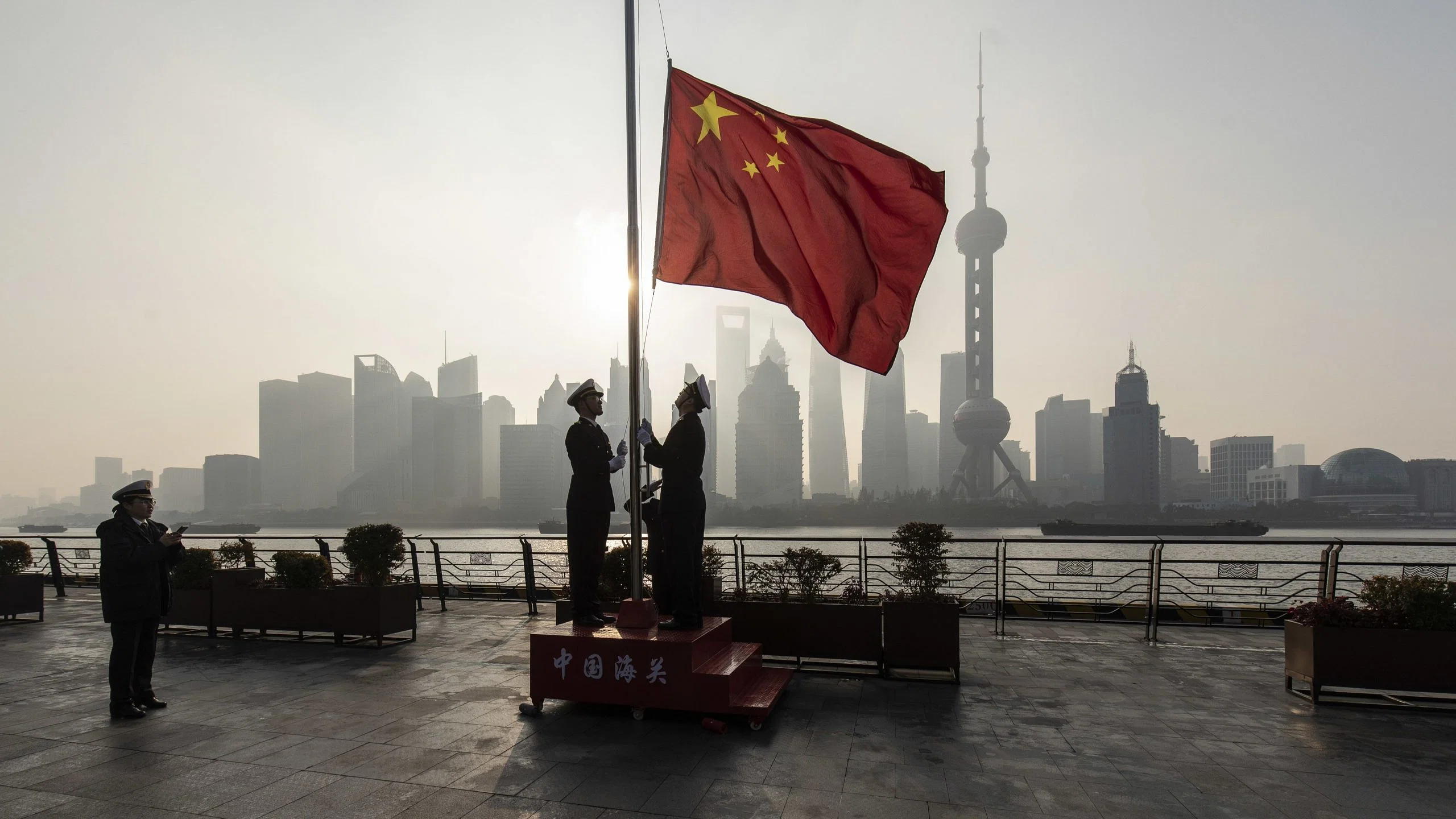

No limits: What China stands to gain from Russia’s war with the West

China's close ties with Russia have allowed Beijing to benefit disproportionately from Putin's war on Ukraine and the West's response. The war increasingly makes Moscow economically beholden to China, keeping Moscow's wartime economy afloat and the West embroiled in a protracted conflict. As it solidifies, the Sino-Russia nexus presents a longer-term threat to global trade.

Freeze and seize: Implications of asset confiscations for Russia, China, and the world

The Russian invasion of Ukraine has elevated the global significance of multi-country asset seizures. If the freezing implemented against Russia is implemented on a larger economic target such as China, then losses to all sides would be even larger due to the size and integration of East Asian capital pools.

Will war in Ukraine unperch US dollar preeminence in global trade?

Will sanctions on Russia reduce the use of the US dollar in trade and undermine its status as the global reserve currency? Will China risk its economic and political position by facilitating large-scale sanctions busting. Learn more from Research Fellow Stewart Paterson’s analysis on the crisis in Europe.

Download the discussion guide

It has been argued that China’s renminbi is well placed to bring an end to the dollar standard as Western nations face the damage of sanctions inflicted on Russia. This discussion guide by the Hinrich Trade Educators Center, however, outlines three observations that suggest this line of reasoning may be overblown or premature.

China will gain economically from the Ukraine war. What might it lose?

A global community with benign assumptions enabled China’s transformation into an economic giant. This article by Senior Research Fellow Stephen Olson charts the further deterioration of this conducive environment, already frayed with US-China rivalry, in the wake of Russia’s invasion of Ukraine. To continue its rise, China must navigate a global order that, rocked by war, may be turning on its head.

Stepping on the gas: the Ukraine war reshapes climate and energy policy

The Ukraine war vividly underscores the vulnerability of fossil fuel importers to geopolitical machinations. In this article, Aaron Cosbey, Senior Associate at the International Institute for Sustainable Development, explains how, in the long run, renewable energy and climate change make the strategic leveraging of oil and gas as self-defeating.

After Ukraine: The new geopolitics of food security

War in Europe has exposed the fragility and vulnerabilities of the world’s food supply system and threatens to intensify both food insecurity and competition. Learn more about how food-related global value chains, like other strategic sectors such as semiconductors and critical materials, face increased fragmentation, regionalization, and localization in this report by Research Fellow Alex Capri.

Quick take: How is China responding to the Ukraine crisis?

China faces tough choices ahead as the Ukraine crisis tests its “no limits” partnership with Russia. This quick take by Senior Research Fellow Stephen Olson explains the potential quandaries weighing down Russia-China trade and investment.

Putin’s gamble shakes up energy trade – and China may gain

Global energy trade is on shaky ground as sanctions face Russia, a major supplier of oil and gas for Europe – and China too. This article by Research Fellow Stewart Paterson explains the potential of the Ukraine crisis in handing Beijing key economic leverage over Moscow.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).