Foreign direct investment

Multiple pathways to upgrading in global value chains in Asia

Published 14 September 2022

Upgrading is the acquisition of technological capabilities and market linkages that allows firms to enhance their supply chain competitiveness and move to higher-value activities. This upgrading occurs in many different forms representing opportunities for decision-makers in Asia.

Countries upgrade GVCs in different forms. In Asia, Vietnam represents one trajectory, its economic model led by foreign direct investment (FDI) but focused on assembly tasks that depend on imports. Foreign multinational enterprises (MNEs) are heavily involved in the country’s economy. South Korea followed a different trajectory. Here, the country experienced a much larger role for domestic MNEs, and the economic model is more dependent on the exports it provides others. Both are widely deemed successful cases of development in their own right, highlighting the multiple potentially beneficial pathways to GVC involvement in Asia. Importantly, the pathway is right for the technological and socioeconomic context — not all countries achieve this.

When considering this context, there are two broad pathways regions can upgrade – both horizontally and vertically. Horizontal upgrading refers to the development of a new GVC product or industry in a region that is related to an existing area of specialisation of the local economy. For example, the manufacturing of mobile phones may follow from the existing production of laptops. Horizontal upgrading includes ‘entry into the supply chain’ upgrading[1] that is the initial participation of firms in a local, regional, or global value chain.

Vertical upgrading offers a new function for the local economy, for example, R&D, or marketing, logistics, headquarters management, and perhaps production in an existing value chain. If horizontal upgrading describes a movement from laptop production to mobile phone manufacturing, vertical upgrading describes the movement from laptop production to laptop design. A particular form of vertical upgrading is backward linkages upgrading. Local firms become active in an industry supplying goods and services to an MNE in a foreign country already engaged in an existing value chain.

The types of linkages and the direction of upgrading are important to consider. Economies can upgrade through forward and backward linkages. Forward linkages, also known as downstream linkages, refer to linkages with firms further along the value chain; that is, firms closer to final goods or eventual export. Backward linkages, also known as upstream linkages, refer to linkages closer to suppliers or initial goods, or creation of services. Upgrading does not necessarily mean moving upstream or downstream. Rather, it is the process of climbing up the value chain in terms of value-add and skills.

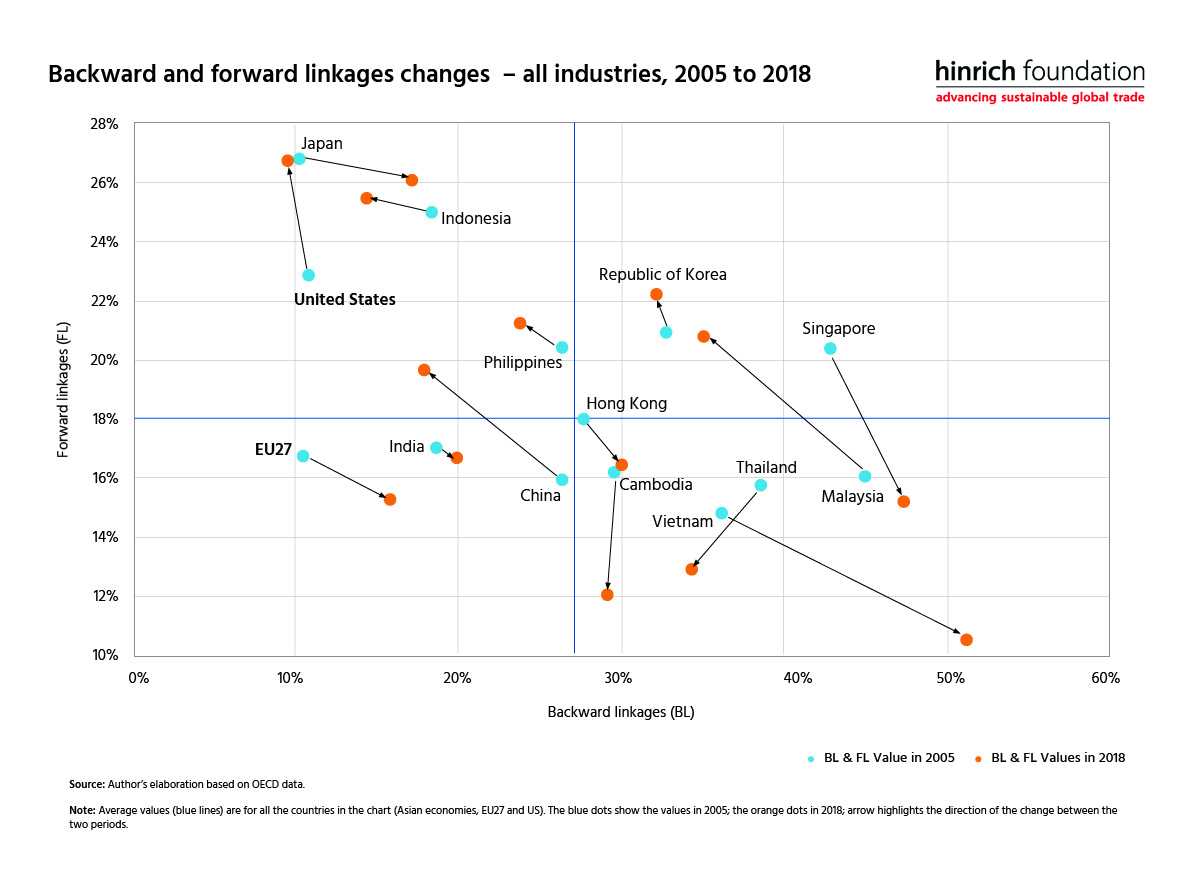

Figure 1 makes it possible to visualize the diversity of possible patterns to upgrading in terms of backward and forward linkages.[2] Backward integration is captured by the country’s vertical specialization share, measured by the import content of the country’s exports. Furthermore, a country also participates in GVCs as a supplier of inputs used in foreign countries’ exports. Hence it is important to account for the share of exported goods and services which are used as intermediate inputs in other countries’ exports – that of forward integration.[3] The combination of these two shares offers a first description of an economy’s participation in GVCs. This contribution is both as a user of foreign inputs – upstream links, that of backward participation – and as a producer of intermediate goods and services used in other countries’ exports; that is – downstream links, that of forward participation.

Figure 1 below shows the position of a set of Asian economies covered by the Organisation for Economic Co-operation and Development (OECD) Trade in Value-Added, or TiVA, indicators in terms of backward and forward linkages for all industries. Backward and forward integration in 2005, represented by the blue dot, is compared with the current position, shown by 2018’s orange dot. Interestingly, no country records an increase in both backward and forward linkages during this period. This evidence is in line with evidence on ‘global stagnation’ of GVCs that predates the Covid-19 crisis.

Figure 1: GVC participation in Asia

On the contrary, Thailand and, to a lesser extent, Cambodia have decreased their shares in both measures of GVC participation; both have become generally less integrated over the past decade. Convincing evidence shows GVC participation facilitates economic development. Therefore, these countries may be losing out by decreasing shares. Public policy can help reverse this outcome.

Figure 1 further shows another group of countries – composed of China, Indonesia, Malaysia, the Philippines, and South Korea (our initial example) – that increased their forward linkages while decreasing backward linkages. The economies in this group all rely less on imported value-add for their own exports but have become increasingly relevant in value generation in countries importing intermediate goods from them. For example, the significant movement recorded by Malaysia might reflect one of these two shifts. Either the country’s shift towards automobile component manufacturing, as inputs into final car construction, or the increase in oil and gas exports, as inputs into petroleum products. Similarly, it reflects the country’s shift into high-tech, with semiconductor devices and electrical products all inputting into mobile devices, storage devices, and photovoltaic panels.

Japan, Hong Kong, Singapore, and more marginally, India showed a drop in forward linkages while increasing their backward linkages. Vietnam makes a considerable movement towards the bottom right corner, that being a larger share of backward linkages compared to forward linkages. This could be due to increases in the tasks for final stage assembly and seems to reinforce the specificity of this particular model of upgrading as discussed above.

For all examples, each country will be competing and trading on different comparative advantages; therefore, there is no ideal GVC direction with increases or decreases in linkages important to consider in local context. What matters is that policy decision-makers are making active GVC-sensitive public policy and investment to encourage task-based specialties.

Early studies of GVCs observed nation states as largely passive and restricted to facilitating the recruiting of lead firm investment.[4] Yet today, there is agreement to act upon this ideal and to deliver on a more pro-active interpretive approach. Active mediation helps to advance national policy priorities and facilitate the coordination of actors. In addition, policymaking for GVCs should include designing and developing policy interventions for local development.[5]

The design of evidence-based GVC-sensitive policies requires an understanding of both the position, and the origin of that position, of each economy. Yet today, there is agreement to deliver on a more pro-active interpretive approach.

***

[1] See Fernandez-Stark, K., P. Bamber and G. Gereffi (2011). "The offshore services value chain: upgrading trajectories in developing countries." International Journal of Technological Learning, Innovation and Development 4(1-3): 206-234.

[2] Taken from the companion White Paper to this blog available at https://www.hinrichfoundation.com/research/wp/fdi/global-value-chains-gvc-foreign-direct-investment-fdi-economic-development/

[3] Hummels, D., J. Ishii and K.-M. Yi (2001). "The nature and growth of vertical specialization in world trade." Journal of International Economics 54(1): 75-96.

[4] Gereffi, G. (1994). "The organization of buyer-driven global commodity chains: how US retailers shape overseas production networks." Contributions in economics and economic history: 95-95.

[5] UNCTAD (2020). World Investment Report 2020: International Production Beyond the Pandemic. UNCTAD.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).