White paper: Exchange rate flexibility essential for reducing trade tensions and achieving more sustainable trade

Published 17 September 2019

A new white paper on the trade imbalances that have driven the global trade system away from equilibrium and contributed to Brexit and to the eruption of the US-China trade dispute.

The paper analyses the causes and consequences of these imbalances, and formulates recommendations for achieving a fairer, more equitable and therefore more sustainable global trading system, and by extension for reducing geopolitical tensions.

According to the white paper, a sustainable global trade system should show a tendency towards balance. However the analysis of current accounts in nominal US dollar terms over the past decades tells us that trade imbalances have grown, become highly concentrated in just a few countries that follow specific currency and industrial policy arrangements, and are now persistent.

"The picture that emerges is one of constant disequilibrium with a large number of countries running severely out-of-balance current account positions, a situation that pre-dates the global financial crisis and has continued in its aftermath."Stewart Paterson - Research Fellow of the Hinrich Foundation

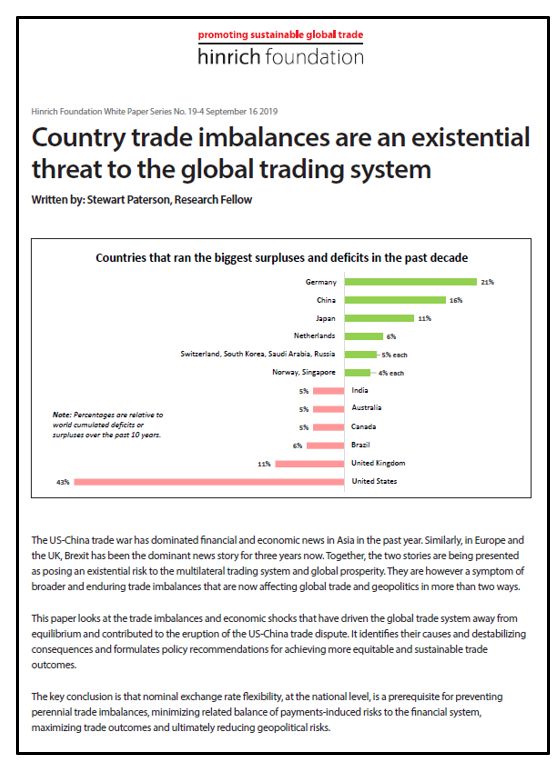

Taking the past ten years (2009-2018 inclusive), only 16 countries, out of the 96 reviewed, had an average current account position of +1% or -1% of GDP or less (i.e. more or less balanced). Eight countries have accounted for 80% of the world’s current account deficits and six countries have accounted for 66% of the world’s current account surpluses.

Nearly two-thirds of countries have been running average annual current account positions that are severely out of balance. In fact, on average the mean current account deviation from balance among 96 countries over the past 10 years has been 6.7% of GDP.

According to the author, the cause of these imbalances has been the absence of free-floating exchange rates at the national level. This has prevented current account rebalancing and prolonged the duration of trade imbalances. The consequences include higher financial crisis risks, sub-optimal trade outcomes (in terms of employment and growth) and heightened geopolitical tensions.

The aim of the WTO was to create a more market driven environment for trade but the major participants in the system are not pursuing market driven economic policies, which brings about distortions in global trading patterns.

"Those who wish to see the current multilateral system and institutions survive, must ensure that the mechanisms to restore trade balance, such as nominal exchange rate flexibility, are allowed to work."Stewart Paterson - Research Fellow of the Hinrich Foundation

Methodology

This study uses data from the World Bank Open Database for current accounts in US dollar nominal terms and relative to a country’s own GDP. For India, this paper has added the numbers for the year ended March 2019 from the Reserve Bank of India. All data is from the World Bank database unless otherwise specified (the real effective exchange rate data comes from the Bank of International Settlement, for example). This represents a complete dataset for 98 countries which collectively account for 99% of world GDP. Data for a smaller number of crucial countries is available going back further in time.

About the author

Stewart Paterson is a Research Fellow at the Hinrich Foundation and the author of “China, Trade and Power: Why the West’s Economic Engagement Has Failed”. He spent 25 years in capital markets as an equity researcher, strategist and fund manager. He has worked in London, New York, Mumbai, Tokyo, Hong Kong and Singapore. He served as the Managing Director and Chief Asian Equity Strategist at Credit Suisse AG in Hong Kong and previously headed European and Indian Research at CLSA. He holds an M.A. (Hons.) degree in Economics from the University of Aberdeen.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).