Sustainable trade

Counting carbon: The implications of border carbon adjustments on developing countries

Published 14 December 2021

Border carbon adjustment (BCA), once an obscure policy understood by few, is now front and center in the ongoing global conversation on carbon pricing, trade, and climate policy. Despite its newfound currency, however, BCA remains poorly understood. What is BCA and what is its potential impact for developing countries?

Straightforward – on paper

At a conceptual level (though certainly not in practice), BCA is straightforward. It accompanies domestic carbon pricing and imposes charges on imports. Thus, imports would bear the same burden of carbon pricing as domestically produced goods. One variation on BCA would also remove the carbon price on exports, in the same way many countries do for value-added taxes. Advocates for BCA reason that domestic carbon pricing advantages foreign producers not facing a carbon price – in essence, emissions ‘move’ abroad as domestic producers lose market share. This process, which means domestic carbon pricing would have little or no impact on global emissions, is ‘carbon leakage’.[1]

If a BCA accompanied a domestic carbon tax, it would function much like a value-added tax, enforcing tax adjustments at the border. On the other hand, if BCA accompanied regulatory carbon pricing such as an emissions trading scheme (ETS), it would mirror that domestic scheme by applying the regulations at the border; for example, requiring importers to purchase emission allowances.

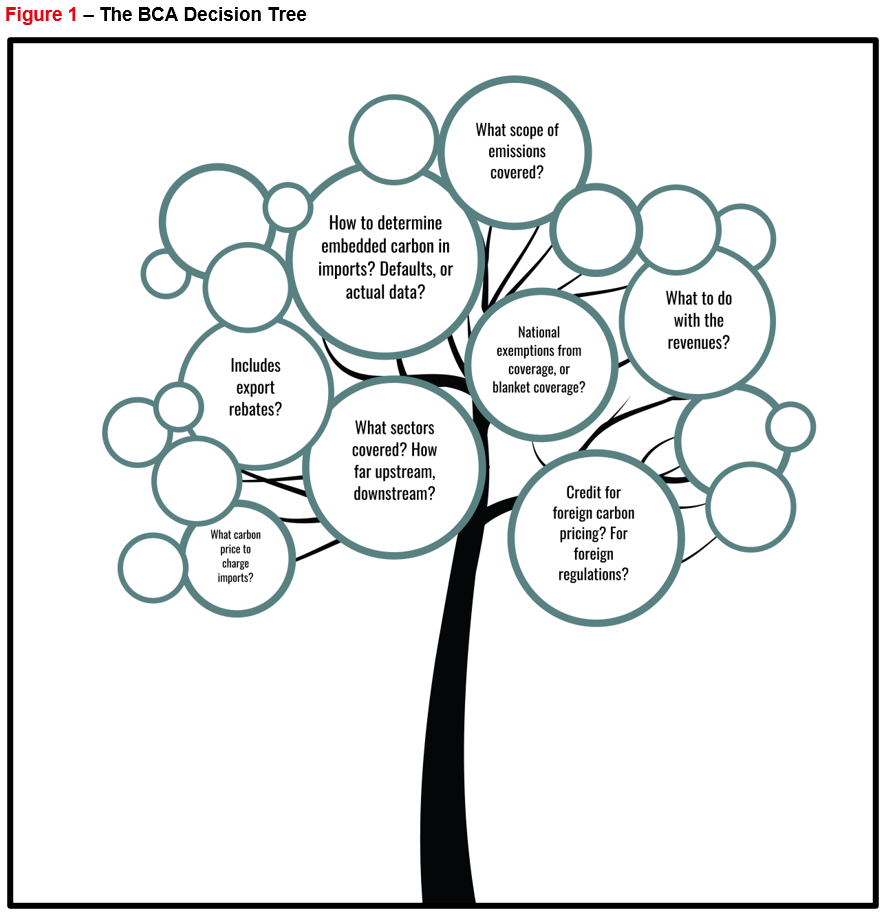

Beyond those generalities, however, there is no single accepted form of a BCA. Rather than a single policy, a BCA can be viewed like a decision tree, with myriad options in the process of elaboration that result in very different final outcomes (see Figure 1).

Approaches to the BCA differ. The European Union is proposing a Carbon Border Adjustment Mechanism (CBAM) that would accompany its ETS and cover 29 basic goods and semi-finished goods in four sectors: aluminum, steel, cement, and fertilizers.[2] The proposed CBAM would come into force in 2023, but the first three years would consist of record collection before any charges started to apply. The CBAM charge would then ramp up from 2026 onwards, as free allocation of allowances in the EU’s ETS slide down to zero. Currently being negotiated to final agreement by the Commission, the European Parliament, and the Member States as represented by the European Council, the CBAM is in a process of completion that may take another year or more.

Other countries have expressed an interest in BCA but are not as far along in the process. The UK has explored putting a BCA in place if the CBAM is implemented, given the close alignment between its ETS and that of the EU.[3] Canada has launched consultations on what a domestic BCA might look like.[4]

The US has repeatedly pledged to implement some form of BCA, but its possible framework is not clear, given that the US has no carbon price for which to adjust.[5] The most recent proposal involved border charges that would be the price equivalent of all internal regulatory measures, with no credit for foreign regulatory measures. Another recent development is the US-EU bilateral agreement on steel and aluminum, which rolls together commitments to somehow ban the imports of high-carbon goods and address excess supply (with clear reference to China). Both proposals involve a worrying conflation of environmental protection and protectionism. By contract, the EU’s proposal is explicitly focused on an environmental goal – the prevention of leakage.

The current rash of interest in BCA is directly linked to rising climate ambition. The EU, the UK, and Canada have recently passed into law its net zero ambition and strengthened carbon pricing. The Biden Administration in the US has announced ambitious goals for climate action. Other jurisdictions will likely consider their own BCAs.

Indeed, the current interest in BCAs is part of a broader trend toward the counting of carbon in traded goods and global carbon pricing. Partly due to the CBAM proposal, the OECD is proposing to coordinate global carbon pricing,[6] the IMF is presenting a scheme for an international minimum carbon price floor,[7] and the WTO’s Director-General is calling for international coordination on carbon pricing.[8] German Chancellor Olaf Schultz has also proposed a ‘carbon club’ of climate-ambitious countries.[9] For their part, the US and the EU have pledged to enact a “club” arrangement on steel and aluminum that excludes high-carbon steel from either market by the year 2024.[10] One way or another, the future of global trade involves more focus on the carbon footprint of traded products.

Implications for developing countries

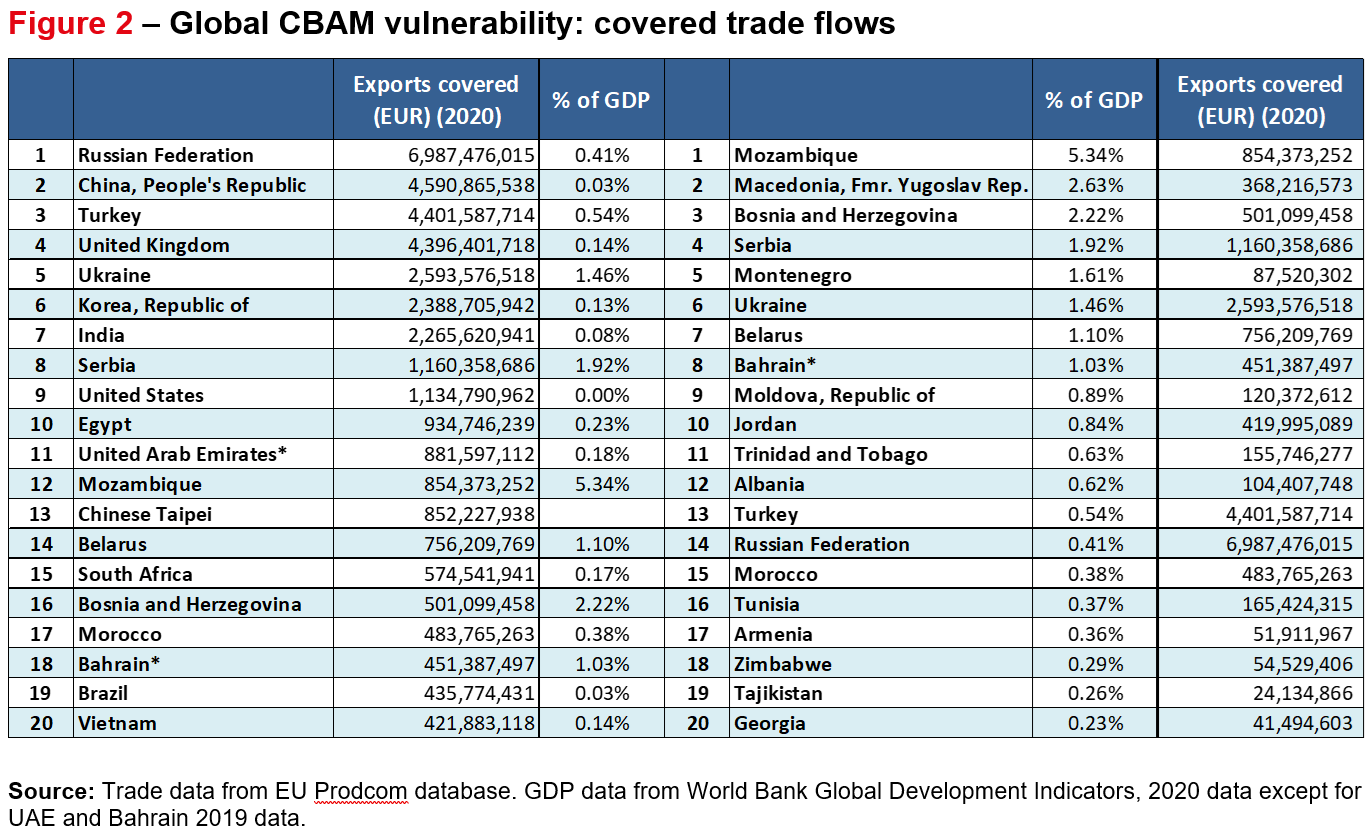

To fully appreciate the potential impact of BCA on developing countries, it is useful to focus on a specific proposal, of which the EU’s CBAM is the most advanced. Table 1 below shows the top 20 countries affected globally, by volume of trade flows in the goods covered in the Commission proposal.

It is noteworthy that large, relatively diversified countries such as China, South Korea and India have high exposure in terms of absolute export values – with individual firms clearly vulnerable – but are not among the top 20 countries in exposure by percentage of national GDP. That latter category is comprised in large part by near neighbours of the EU in Eastern Europe and Central Asia.

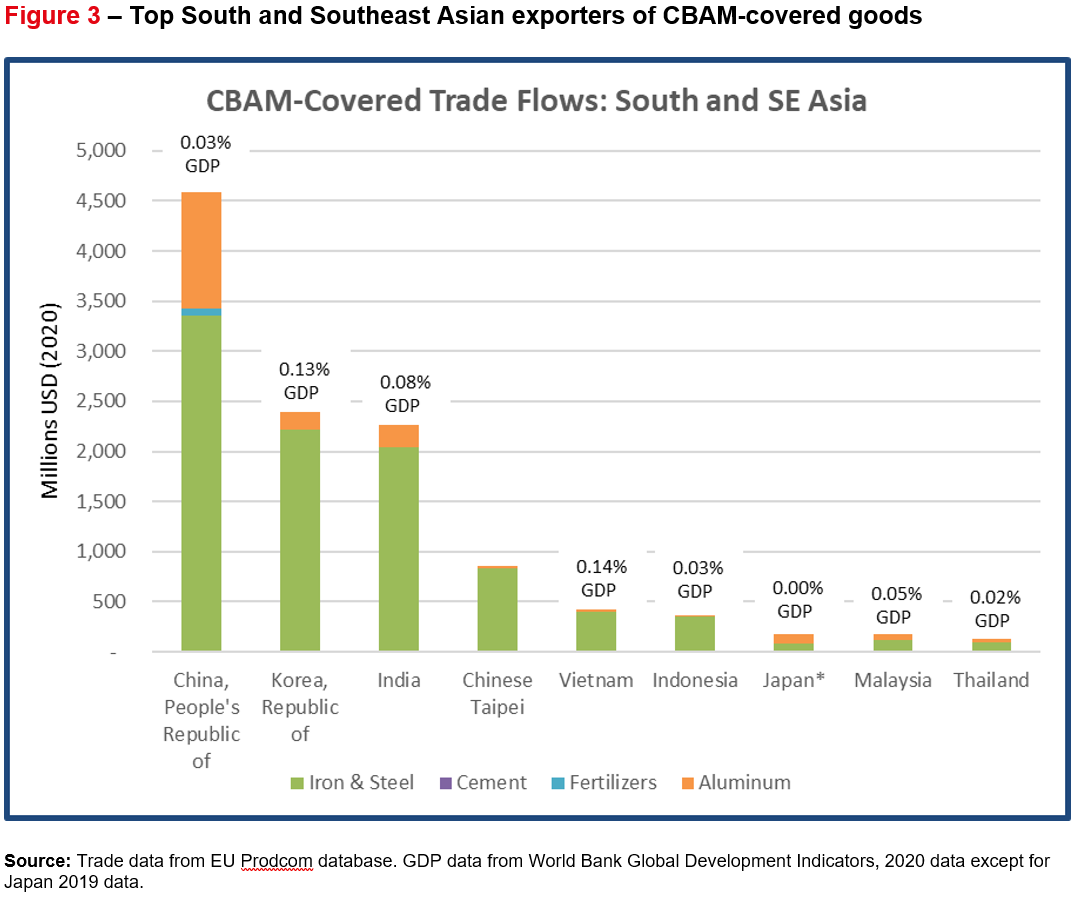

Figure 3 shows covered trade flows from the most significant exporters in South and Southeast Asia. Vulnerability is almost all in the iron and steel sector, with some aluminium from China also at stake. Indeed, China is clearly most exposed in absolute terms, followed by the Republic of Korea and India. However, Vietnam’s exports comprise the highest share of any national GDP, at 0.14%, closely followed by the Republic of Korea at 0.13%.

It is important to note that the trade numbers in Figure 2 and Figure 3 are not projected losses of market share. Instead, they are total existing flows. As such, they show the extent of the trade flows that would be impacted by the proposed CBAM. Those trade flows would likely suffer reductions, particularly if the foreign producers have a higher carbon footprint than EU producers, but they would not be eliminated

Since the proposed CBAM demands actual data from foreign producers, producers from outside the EU with relatively low greenhouse gas emissions (GHG) might even gain market advantage. Firms with emissions intensity lower than EU producers will face lower carbon costs in the EU market and enjoy a cost advantage.

For now, the CBAM looks to only cover direct (scope 1) production emissions, which advantages newer plants and innovative low-carbon processes. But eventually it will likely cover emissions from purchased electricity as well (scope 2). When that happens, the purchase of low-carbon electricity will also be an advantage for producers. For any gain in competitiveness to accrue, however, the cost advantage would have to be enough to offset the potentially significant costs of compliance with CBAM, including internal carbon accounting, accounting up the value chain, and verifying emissions data.

One of the fundamental controversies with respect to BCA is the incidence of burden. Some studies have shown that the main burden in a BCA scenario falls on developing country exporters, who would lose market share in implementing market countries.[11] This does not square well with the established principle of common but differentiated responsibility and respective capabilities (CBDR-RC), which holds that developed countries should take leadership roles in addressing climate change, given their historical contributions to the problem, and their superior capacity to address it.

This is an inherent tension in BCA. To some extent, it can be addressed by the choice of design elements in the instrument, to ensure that foreign producers face requirements no more onerous than those faced by domestic producers. Even then, however, if the foreign producers use high-carbon production methods, they will be penalized as part of efforts to “clean up” the carbon footprint of EU consumers.

To be fair to EU policymakers, the principle of CBDR-RC also calls on developed countries to show leadership in reducing emissions. It is hard to see how they might do so if they do not take measures to avoid leakage.

Strategic recommendations for developing countries

In anticipating CBAM and subsequent similar initiatives, what strategic options are open to developing country exporters and governments?

One option is to challenge such measures under WTO law. However, this is unlikely to produce a satisfactory outcome. Even if the EU were to lose the case – and that is not a certainty – it would take many years to settle, with a timeline complicated by the absence of a functioning Appellate Body. Ultimately the EU might not even abide by the ruling and instead opt to pay compensation or allow the complainants to suspend concessions.

Outside the route of WTO complaint, three broad types of strategies are open to developing country policymakers.

Push for favourable design features. As discussed, the final shape of any BCA could be very different, depending on choices made in its design. For example, a BCA that did not credit for foreign carbon prices paid would become a tool of protectionism rather than environmental protection. Similarly, some have suggested that some BCA revenues should be used to support affected developing country firms and countries.[12] Either individually or in concert, developing countries should push for principles and best practices that help ensure that any BCA works to prevent leakage and respects the principle of CBDR-RC, rather than to unfairly advantage domestic producers.[13] Some have suggested that such discussions might be anchored in a multilateral forum such as the World Trade Organization.[14]

Pursue carbon pricing. Affected countries could institute carbon pricing domestically or on a regional basis, to ensure that carbon taxes paid by their industry are paid to home coffers rather than to foreign authorities. The impacts of BCA alone probably do not justify domestic carbon pricing – in itself, not a simple exercise – in any but the most affected countries. However, carbon pricing has other domestic benefits and addressing foreign BCAs adds one more benefit to the list. Established regional cooperation platforms such as ASEAN and APEC might be valuable in exploring a coordinated approach to carbon pricing that would lower the administrative burden for any single country.

Support the decarbonization of domestic industry. Given their respective capabilities, developing countries can help emissions-intensive industries to decarbonize and equip them to take advantage of international carbon pricing. This could involve fiscal incentives, grants, support for research and development, supported demonstration projects, government procurement of low-carbon goods, and other means. Governments might also support domestic firms by compiling the sort of data that will be demanded by foreign BCA schemes, such as sectoral emissions intensity measurements. Support from the international community should be extended throughout.

Ultimately, future trade of some products will involve an accounting of their embodied carbon and penalties for GHG-intensity in the form of lost market share. There are threats and opportunities for developing country exporters in that future. Governments can serve their exporting sectors best by understanding and acting on both.

[1] - See Droege, S. (2009). “Tackling Leakage in a World of Unequal Carbon Prices.” Climate Strategies Working Paper.

[2] - Text of the proposal can be found at https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX:52021PC0564.

[3] - The UK’s Environmental Audit Committee convened an inquiry on this question in 2021. Background available at: https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX:52021PC0564.

[4] - See the announcement of consultations and the accompanying background paper at: https://www.canada.ca/en/department-finance/programs/consultations/2021/border-carbon-adjustments.html.

[5] - Most recently that commitment appears in the United States Trade Representative’s 2021 Trade Policy Agenda and 2020 Annual Report. Available at: https://ustr.gov/sites/default/files/files/reports/2021/2021%20Trade%20Agenda/Online%20PDF%202021%20Trade%20Policy%20Agenda%20and%202020%20Annual%20Report.pdf.

[6] - Fleming, S. and C. Giles (2021): OECD Seeks Global Plan for Carbon Prices to Avoid Trade Wars. Financial Times. September 13, 2021.

[7] - Parry, I., S. Black, and J. Roaf (2021): Proposal for an International Carbon Price Floor among Large Emitters. IMF Staff Climate Notes 2021/001.

[8] - Okonjo-Iweala, N. (2021): Adopting a global carbon price is essential. Financial Times, October 14, 2021

[9] - German Finance Ministry (2021). Schritte zu einer Allianz für Klima, Wettbewerbsfähigkeit und Industrie - Eckpunkte eines kooperativen und offenen Klimaclubs https://www.bundesfinanzministerium.de/Content/DE/Downloads/eckpunkte-internationaler-klimaclub.pdf?__blob=publicationFile&v=3.

[10] - U.S. White House (2021). “The United States and European Union to Negotiate World’s First Carbon-Based Sectoral Arrangement on Steel and Aluminum Trade.” October 31. https://www.whitehouse.gov/briefing-room/statements-releases/2021/10/31/fact-sheet-the-united-states-and-european-union-to-negotiate-worlds-first-carbon-based-sectoral-arrangement-on-steel-and-aluminum-trade/.

[11] - Böhringer, C., J. C. Carbone, and T. F. Rutherford (2012). “Unilateral Climate Policy Design: Efficiency and Equity Implications of Alternative Instruments to Reduce Carbon Leakage.” Energy Economics 34 (S2): S208-S217

[12] - Gore, T., E. Blot, A. Cosbey, T. Voituriez, L. Kelly and J. Keane (2021). “What Can Climate Vulnerable Countries Expect from the CBAM?” Institute for European Environmental Policy Briefing Paper. https://ieep.eu/publications/what-can-climate-vulnerable-countries-expect-from-the-cbam.

[13] - Cosbey, A. (2021). “Principles and Best Practice in Border Carbon Adjustment: A modest proposal.” Trade and Sustainability Review, Vol. 1(4). https://www.iisd.org/publications/iisd-trade-sustainability-review-volume-1-issue-4-november-2021.

[14] - Bernasconi-Osterwalder, N., and A. Cosbey (2021). “Carbon and Controversy: Why we need global cooperation on border carbon adjustment.” International Institute for Sustainable Development. https://www.iisd.org/articles/carbon-border-adjustment-global-cooperation.

© The Hinrich Foundation. See our website Terms and conditions for our copyright and reprint policy. All statements of fact and the views, conclusions and recommendations expressed in this publication are the sole responsibility of the author(s).